How Wall Street Analysts Rate Vornado

Analysts assigned VNO a mean price target of $89.52, 13.8% higher than its current price level.

July 27 2017, Updated 9:07 a.m. ET

Analyst ratings

Wall Street analyst ratings offer some insight into Vornado Realty Trust’s (VNO) 2Q17 performance. Analysts assigned VNO a mean price target of $89.52, 13.8% higher than its current price level.

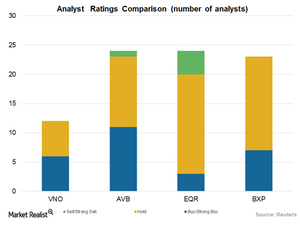

Currently, six out of 12 analysts have assigned VNO a “buy” or “strong buy” rating. The remaining six analysts allotted it a “hold” rating. The strategic decision of disposing of its underperforming assets and concentrating more on its core business has made the analysts bullish on the stock. Vornado has recently completed the sale of its JBG Smith business in Washington D.C. and has completely transformed itself into a business based solely in New York. This step has helped the company focus more on higher revenue generating business.

Compared to the ratings issued in April 2017, VNO’s “strong buy” and “buy” ratings have increased from five to six.

Peer ratings

Among Vornado’s major peers, 11 of 23 analysts gave AvalonBay Communities (AVB) a “buy” or “strong buy” rating. 12 analysts assigned AVB a “hold” rating, and one analyst allotted the company a “sell” or “strong sell” rating.

Three of 24 analysts covering Equity Residential (EQR) gave the company a “buy” or “strong buy” rating. Seventeen analysts allotted it a “hold” rating, and four analysts assigned it a “sell” or “strong sell” rating.

Seven of 23 analysts covering Boston Properties (BXP) gave it a “buy” or “strong buy” rating. Sixteen analysts gave BXP a “hold” rating. No analysts gave the stock a “sell” or “strong sell” rating.

Vornado and its residential REIT peers constitute 12.4% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s broadly diversified portfolio in terms of geography as well as products cushions investors against macroeconomic headwinds and volatility.