Equinix’s Latest Performance and Future Projections

Equinix’s (EQIX) revenue rose at a four-year CAGR (compound annual growth rate) of 19% to $4.4 billion in 2017.

Oct. 22 2018, Updated 10:30 a.m. ET

Equinix’s performance

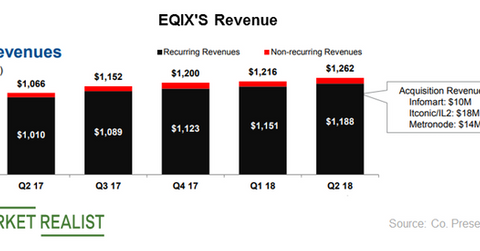

Equinix’s (EQIX) revenue rose at a four-year CAGR (compound annual growth rate) of 19% to $4.4 billion in 2017. Its net income rose at a four-year CAGR of 25% to $233 million. Its revenue rose 23% to $2.5 billion in the first half of 2018.

China Mobile, Lithia Motors, and Tencent (TCEHY) were some of the company’s crucial customers. Equinix continued to extend its international platform, which included the acquisition of assets from Infomart, Metronode, and Verizon (VZ). It finalized the incorporation of Terremark Federal Group into Equinix Government Solutions.

EQIX projections

The company’s revenue projections for 2018, 2019, and 2020 are $5.1 billion, $5.6 billion, and $6.1 billion, respectively. Its expected net incomes are $302 million, $497 million, and $658 million, respectively. The stock has “strong buy,” “buy,” and “hold” recommendations from eight, 14, and two analysts, respectively. Its expected PE multiples for these years are 107.2x, 66.7x, and 51.7x, respectively.

EQIX compared to the NASDAQ

At the end of last week, the NASDAQ Composite Index had beaten EQIX in the last month, in the last three months, in the last year, and year-to-date. The stock closed at a 20% discount to its 52-week high and a 7% premium to its 52-week low at the end of the week.

Some recent events

Charles Meyers was appointed as Equinix’s CEO in September. He succeeded interim CEO Peter Van Camp.

Equinix also recently invested $78 million in its largest data center in Singapore, and it announced the extension of the Equinix Internet Exchange into Bogotá, Colombia, in October. It also announced a second data center in Sofia, Bulgaria.