An Overview of Johnson & Johnson’s Neuroscience Segment

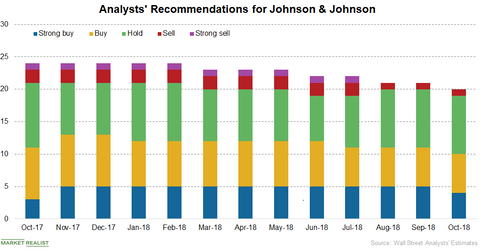

Of the 20 analysts tracking Johnson & Johnson stock in October, four recommended a “strong buy” while six analysts recommended a “buy.”

Oct. 9 2018, Updated 11:31 a.m. ET

Neuroscience segment’s revenue trends

In the first half, Johnson & Johnson’s (JNJ) Neuroscience segment generated revenues of $3.1 billion compared to $3.0 billion in the first half of 2017, reflecting ~4.1% YoY (year-over-year) growth. In the US and international markets, Johnson & Johnson’s Neuroscience segment generated first-half revenues of $1.26 billion and $1.82 billion, respectively, compared to $1.28 billion and $1.68 billion in the first half of 2017. This reflected an ~1.6% decline and 8.6% growth on a YoY basis.

Johnson & Johnson’s neuroscience drugs—Concerta, Invega Sustenna, and Risperdal Consta—generated revenues of $356.0 million, $1.4 billion, and $384.0 million, respectively. This trend reflects an ~8.7% decline, ~14.8% growth, and ~7.2% decline on a YoY basis.

JNJ’s Neuroscience pipeline

Johnson & Johnson’s (JNJ) three drug candidates are in the late stage of the clinical pipeline. Johnson & Johnson is conducting a Phase 3 trial of esketamine for the treatment of treatment-resistant depression and major depressive disorder with minimal risk of suicide. Johnson & Johnson is conducting a Phase 3 trial with ponesimod for the treatment of relapsing multiple sclerosis.

Johnson & Johnson’s late-stage pipeline in neurosciences includes paliperidone palmitate six-month long-acting injectable for the maintenance treatment of schizophrenia.

Stock performance

On October 3, Johnson & Johnson’s stock price closed at $139.03. This is an ~1.03% decline from its October 2 closing price of $140.48. Johnson & Johnson’s October 3 stock price represents ~25.0% growth from its 52-week low of $118.62 on May 29. Johnson & Johnson’s stock price hit its 52-week high of $148.32 on January 17.

Analysts’ recommendations

Of the 20 analysts tracking Johnson & Johnson stock in October, four recommended a “strong buy” while six analysts recommended a “buy.” Nine analysts recommended a “hold” while one analyst recommended a “sell.”

On October 3, Johnson & Johnson had a consensus 12-month target price of $143.79, which is an ~3.42% return on investment over the next 12 months.