Why Is Morgan Stanley Optimistic about Apple?

According to a report from Apple Insider, Morgan Stanley expects Apple to offset the threat of longer replacement cycles with the iPhone Xs.

Dec. 4 2020, Updated 10:53 a.m. ET

iPhone Xs will offset the threat of longer replacement cycles

According to a report from Apple Insider, Morgan Stanley (MS) expects Apple to offset the threat of longer replacement cycles with the iPhone Xs.

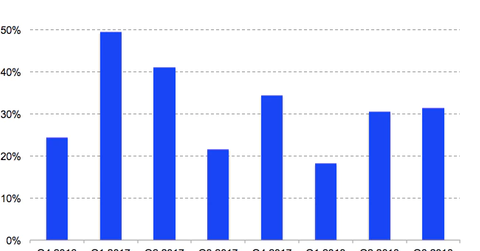

Analysts’ estimates for iPhone shipments have been conservative as smartphone replacement cycles have increased in length over the last two years, resulting in a global smartphone unit shipment decline over the last three quarters.

Wall Street expects iPhone shipments to rise 0.6% YoY (year-over-year) to 220 million units in 2019 compared to an estimated rise of 0.9% in 2018. Morgan Stanley stated that ~46% of iPhone users own an iPhone 6s or older device, indicating that 300 million iPhones are now three years old or more, and a substantial amount will likely be part of an iPhone upgrade.

Apple Video

Morgan Stanley has raised Apple’s price target from $232 to $245, as it believes Apple Video will be a key revenue driver for its Services business in 2019. The investment bank expects the streaming service to have 50 million paid subscribers by the end of 2025 at a price of $7.99 per month.

This increase in subscribers should result in incremental annual revenue of close to $5 billion for Apple in 2025, up from $500 million in 2019. Netflix (NFLX) has ~130 million subscribers and expected revenue of $15.85 billion in 2018.

Morgan Stanley analyst Katy Huberty also expects Apple Music’s revenue to reach $18 billion by 2025, up from $4 billion this year. Apple’s annual Services revenue could reach between $124 billion and $143 billion by the end of 2025, indicating a compound annual growth rate of between 19% and 21%.