PEG multiple

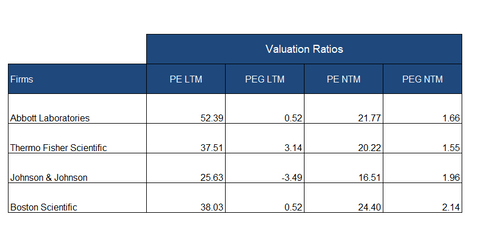

For a growth-adjusted valuation multiple, let’s take a look at Abbott Laboratories’ PEG (PE-to-growth) multiple. On September 19, Abbott Laboratories had a 12-month forward PEG multiple of ~1.7x compared to the ~1.5x PEG multiple it reported in May.

On September 19, Abbott Laboratories’ peers Johnson & Johnson (JNJ), Thermo Fisher Scientific (TMO), and Boston Scientific (BSX) had forward PEs of 16.5x, 20.2x, and 24.4x, respectively, and forward PEG multiples of 1.9x, 1.5x, and 2.1x, respectively.

Abbott Laboratories’ PEG multiple is lower than those of its peers, which suggests that the company’s higher forward PE is more representative of its high growth expectations.

ABT stock seems to be trading at higher valuations than a few months ago, as the company has strengthened its position with an impressive financial performance, product approvals, product launches, and key collaborations and partnerships. Abbott Laboratories was trading at its 52-week high on September 14. The company has successfully overcome the tough times it faced with the big-ticket acquisitions of St. Jude Medical and Alere in 2017.