How Alibaba’s and Amazon’s Operating Costs Have Grown

Alibaba’s operating expenses increased 92% to 29.2 billion yuan ($4.4 billion) in the quarter ended June 30, 2018.

Sept. 26 2018, Updated 7:34 a.m. ET

The main ingredients of Alibaba’s operating expenses

Alibaba’s (BABA) operating expenses increased at a three-year CAGR (compound annual growth rate) of 36% to 73.9 billion yuan ($12 billion) in the fiscal year ended March 31, 2018. The increase was due to higher product development expenses and higher general and administrative expenses associated with higher payroll and benefits expenses, including share-based compensation expenses.

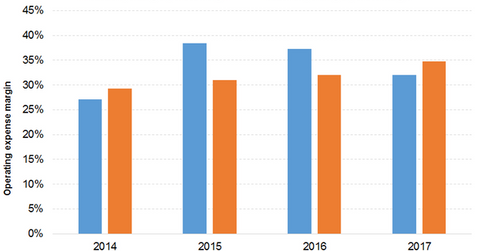

Sales and marketing expenses rose due to an increased marketing and promotional outlay for user acquisitions, including share-based compensation expenses. However, the growth in expenses has decreased from 106% in 2015 to 46% in 2018. Its operating expenses used up 38% of its revenue in 2015 compared to 30% in 2018.

Alibaba’s operating expenses increased 92% to 29.2 billion yuan ($4.4 billion) in the quarter ended June 30, 2018. Product development expenses, sales and marketing expenses, and general and administrative expenses, including share-based compensation expenses, drove the increase in expenditures. Alibaba’s expenditures consumed 36% of its revenue in the June 2018 quarter compared to 30% in the June 2017 quarter.

What drove Amazon’s operating expenses?

Amazon’s (AMZN) operating expenses rose at a three-year CAGR of 33% to $61.8 billion in the fiscal year ended December 31, 2017. Its expenses increased 27% in 2015 compared to 42% in 2017. Fulfillment, technology, and content expenses led to the increase in expenses. Operating expenditures consumed 29% of Amazon’s revenue in 2014 compared to 35% in 2017.

Its operating expenses rose 44% to $37.7 billion in the six months ended June 30, 2018. Higher fulfillment, technology, and content expenses continued to drive expenditures, which consumed 35%–36% of its revenue.

Peers’ operating expenses

JD.com (JD) had operating expenses of 51.7 billion yuan ($7.9 billion) and 31.7 billion yuan ($4.8 billion) in 2017 and the six months ended June 30, 2018, respectively.

Walmart (WMT) had operating expenses of $106.5 billion and $52.5 billion in the fiscal year ended January 31, 2018, and the six months ended July 31, 2018, respectively.

We’ll look at Alibaba’s and Amazon’s operating incomes and margins in the next part.