General Electric’s 1Q17: Are Analysts’ Revenue Estimates Right?

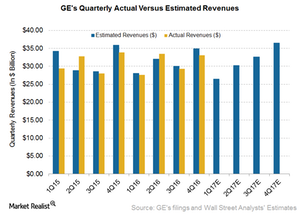

Analysts expect General Electric (GE) to achieve revenue of $26.4 billion in 1Q17. On a year-over-year (or YoY) basis, this represents a fall of 5.8%.

April 17 2017, Updated 11:35 a.m. ET

Analysts’ estimates

Analysts expect General Electric (GE) to achieve revenue of $26.4 billion in 1Q17. On a year-over-year (or YoY) basis, this represents a fall of 5.8%. On a full year basis, analysts expect GE to achieve revenue of $125.7 billion in the next four quarters. Their estimate was $124.9 billion for the last four quarters.

Are analysts right?

General Electric mentioned earlier that it expects 3%–5% organic revenue growth in 2017. Its 1Q17 results will be the litmus test. At times, analysts don’t hit the chord when it comes to estimates. We’ll quickly review General Electric’s business verticals to see if analysts have done their homework. GE has been acquiring and divesting businesses that typically match its new plan to become the number one digital industrial company in the world.

Recently, President Donald Trump hinted that he would revive the Export-Import Bank of United States. This bank offers loans to foreign companies, empowering them to buy US manufactured goods. If this proposal goes through, it could significantly boost the businesses of Boeing (BA) and General Electric, which have sizeable customer bases outside the United States.

Trump’s 2018 defense budget calls for more spending—a blessing in disguise for defense companies (LMT) such as General Electric. However, the company has steadily reduced its exposure to military products over past few years. GE’s orderbook in terms of power turbines, healthcare equipment, and aircraft engines has been good recently. Its strengths in aviation, power, and healthcare are expected to support its future revenue growth.

Though GE tried to find a solution for its ailing oil and gas business, many analysts are skeptical about the outcomes of its deal with Baker Hughes (BHI). Major research house JPMorgan Chase has maintained an “underweight” rating on GE. However, with the rig count improving sequentially, sentiments might turn positive in that space.

ETF discussion

Investors interested in GE could opt for the iShares Global Industrials ETF (EXI). GE makes up 6.6% of EXI’s portfolio. Other major industrial names in this ETF include 3M Company (MMM), Honeywell International (HON), United Technologies (UTX), Union Pacific (UNP), and United Parcel Service (UPS).

In the next article, we’ll review analysts’ take on GE’s operating margin in 1Q17.