Analyzing Sherwin-Williams’s Ability to Service Its Debt

Sherwin-Williams’s (SHW) interest expense has increased significantly due to borrowings for the Valspar acquisition.

Sept. 27 2018, Updated 12:45 p.m. ET

Sherwin-Williams’s interest expense

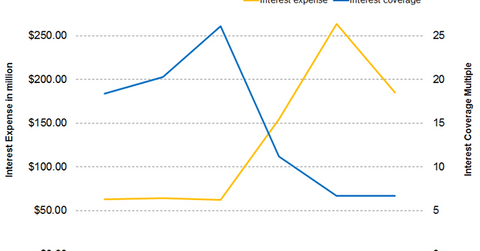

Higher debt means higher interest expense. Sherwin-Williams’s (SHW) interest expense has increased significantly due to borrowings for the Valspar acquisition. From 2013 to 2015, the company’s interest expense remained stable at ~$64 million. However, the interest expense started to increase in 2016. By the end of 2018, Sherwin-Williams’s interest expense is expected to be at ~$370 million.

On the flip side, we can expect Sherwin-Williams’s interest expense to come down. Debt reduction has taken priority over share repurchases. The company temporarily suspended its share repurchase program.

Interest coverage ratio

The interest coverage ratio is an indication of how well a company can service its debt. We can determine the interest coverage ratio by dividing the company’s EBIT by its interest expense. A higher multiple tells us that a company can efficiently service its debt.

The above graph indicates that Sherwin-Williams’s interest coverage ratio has deteriorated from its high level. However, investors shouldn’t be concerned. The interest coverage ratio is expected to improve in the future due to the increased EBIT and a possible reduction in the interest expense.

At the end of the second quarter, Sherwin-Williams’s interest coverage ratio was 6.7x. Currently, the company’s interest coverage ratio is lower than the industry average of 7.8x. PPG Industries (PPG), RPM International (RPM), and Axalta (AXTA) have interest coverage ratios of 21.8x, 6.4x, and 14.0x, respectively. Except for PPG Industries, Sherwin-Williams’s interest coverage ratio is still better than its peers, which suggests that Sherwin-Williams can efficiently service its debt.

Investors could hold Sherwin-Williams indirectly by investing in the Invesco DWA Industrials Momentum ETF (PRN). PRN has invested 4.6% of its portfolio in Sherwin-Williams as of September 25.