Where Does Vornado Stand after 2Q17 Earnings?

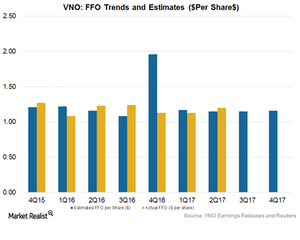

Vornado Realty Trust (VNO) reported core funds from operation (or FFO) of $1.35 per share in 2Q17, which surpassed Wall Street estimates of $1.20 per share.

Aug. 3 2017, Updated 1:43 p.m. ET

2Q17 performance

Vornado Realty Trust (VNO) reported core funds from operation (or FFO) of $1.35 per share, which surpassed Wall Street estimates of $1.20 per share. Adjusted FFO also went up 11.5% compared to 2Q16 results of $1.21 driven by higher demand for the company’s office spaces and lower costs due to the exit of underperforming businesses.

When adjusted for comparability, adjusted FFO stood at $1.25 per share compared to the $1.19 reported a year ago. Earnings per share of $0.43 surpassed the year-ago mark of $0.35 mainly due to lower operating costs resulting from the disposition of assets in its underperforming businesses.

Higher same-store EBITDA (earnings before interest, tax, and depreciation), higher lease-up net operating income, and strong demand for office spaces in Manhattan were the main factors behind the upswing in profit during the quarter.

VNO posted rental revenue of $626 million, missing Wall Street’s estimates of $633.2 million. However, rental revenue came in higher than the $621 million reported a year ago. The higher year-over-year top-line growth reflected higher occupancy and strong demand for office and rental buildings in Manhattan. However, the positive effect was offset by dilution from the company’s aggressive disposition of non-core and underperforming properties.

Dispositions

During 2Q17, Vornado closed the tax-free spin-off of its JBG Smith business in Washington, D.C. The sale is part of the company’s strategy to reposition itself solely in New York. With the sale of the JBG Smith business, Vornado has transformed itself into a New-York-based business with properties located only in revenue-generating Class A cities.

Vornado’s peers who operate in the same industry include companies like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR). AVB reported FFO of $2.04, BXP reported FFO of $1.67, and EQR reported FFO of $0.77.

The iShares Cohen & Steers REIT ETF (ICF) invests 12.4% of its portfolio in Vornado and its REIT peers. ICF’s wide product diversity cushions investors against macro headwinds.