What’s Driving Capex at Verizon?

Verizon has been spending big on capex to improve its network and acquire additional spectrum for future use.

Dec. 4 2020, Updated 10:52 a.m. ET

Verizon is spending big on capex

Previously in this series, we looked at Verizon’s (VZ) plans to launch its commercial 5G (fifth-generation) fixed wireless broadband services in up to four US residential markets before the end of the year. However, it’s important to examine how this move might impact its short-term spending and profitability.

Verizon has been spending big on capex to improve its network and acquire additional spectrum for future use. It spent $3.3 billion on capex in the second quarter compared to $3.9 billion in the year-ago period. It’s focusing its wireless capex on adding capacity and densification of its 4G (fourth-generation) LTE (Long-Term Evolution) network, which includes DAS (Distributed Antenna System) and small-cell solutions. Verizon is also focusing its wireline capex on FiOS installations.

Expected capex investments in 2018

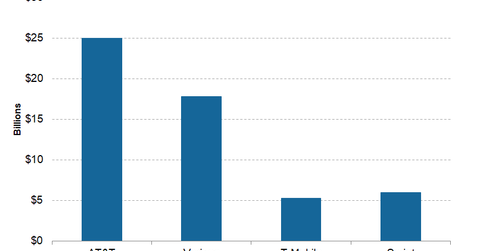

Verizon expects its 2018 capex to be consistent with the past several years, which indicates that it doesn’t expect 5G deployments to erode its profits in 2018. Verizon has guided its 2018 capex at $17 billion–$17.8 billion, which includes the commercial launch of 5G. Its 2017 capex was ~$17.2 billion.

In comparison, AT&T (T) expects to spend $25 billion on capex in 2018, while T-Mobile (TMUS) expects its cash capex to be $4.9 billion–$5.3 billion, excluding capitalized interest. Sprint (S) expects its cash capex to be $5 billion–$6 billion, excluding leased devices, in fiscal 2018, which ends in March 2019.