What Drove Starbucks’s Revenue in 2018?

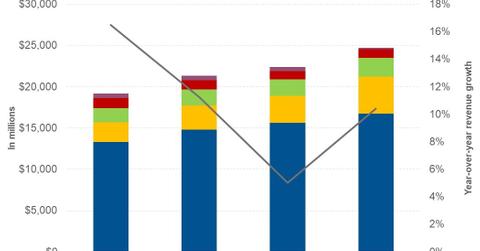

In fiscal 2018, Starbucks (SBUX) posted revenue of $24.72 billion, a rise of 10.4% from $22.39 billion in fiscal 2017.

Dec. 31 2018, Updated 11:10 a.m. ET

Fiscal 2018 performance

In fiscal 2018, Starbucks (SBUX) posted revenue of $24.72 billion, a rise of 10.4% from $22.39 billion in fiscal 2017. The net addition of 1,985 restaurants and global SSSG (same-store sales growth) of 2.0% drove the company’s revenue during the period.

However, the company’s sale of its Tazo brand in the first quarter of fiscal 2018, its sale of its e-commerce business in the fourth quarter of fiscal 2017, and its licensing of its CPG and foodservice businesses to Nestlé offset some of the growth in its fiscal 2018 revenue.

Performance across segments

The Americas segment posted revenue of $16.73 billion in fiscal 2018, representing a rise of 6.9% from $15.65 billion in fiscal 2017. The net addition of 271 company-owned restaurants and 624 franchised restaurants along with positive SSSG of 2.0% drove the segment’s revenue during the period. However, the company’s licensing of its retail operations in Brazil to franchisees offset some of the growth in the segment’s revenue during the period.

Revenue in the China/Asia Pacific segment rose 38.1% to $4.47 billion in fiscal 2018. This revenue growth was driven by the company’s acquisition of its East China business from franchisees and revenue from the opening of 756 new restaurants in the last four quarters. However, its licensing of its Singapore retail operations in the fourth quarter of fiscal 2017 offset some of its revenue growth during the period.

The Channel Development segment posted revenue of $2.30 billion in fiscal 2018, a rise of 2.0% from $2.26 billion in fiscal 2017. This revenue growth was driven by a favorable currency exchange along with growth in the sales of packaged coffee and premium single-serve products, and it was partially offset by the company’s sale of the Tazo brand and its licensing of its CPG and foodservice businesses to Nestlé.

Revenue in the EMEA segment rose 9.0% to $1.05 billion. This revenue growth was driven by a favorable currency exchange and the net addition of 358 franchised restaurants in the last four quarters. However, Starbucks’s number of company-owned restaurants fell by 12 units in the same period, offsetting some of its sales growth.

Revenue in the Other segment fell 45.9% to $168.4 million in fiscal 2018.