Take a Look at Netflix’s Competitive Landscape

All the competition is hurting Netflix’s membership growth. In fiscal Q2 2018, it missed its subscriber guidance for the first time.

Aug. 2 2018, Updated 10:31 a.m. ET

Competition in the US market

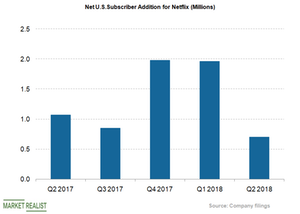

The video streaming market in the United States continues to heat up with the availability of more OTT (over-the-top) players. Stiff competition is hurting Netflix’s (NFLX) subscriber growth. In the graph below, you can see that subscriber additions have fluctuated in the last five quarters. Net membership growth in the United States declined at a CAGR (compound annual growth rate) of 10.1%.

Walmart (WMT) plans to launch its own video streaming service at a lower cost than Netflix and Amazon (AMZN) Prime Video. Netflix charges $10–$12 per month. Netflix’s original content portfolio is helping it downplay its competition.

Other low-cost video streaming players, including Hulu, are also investing heavily in original content. Popular original series such as The Handmaid’s Tale from Hulu and Sneaky Pete from Amazon could increase competition for Netflix. Recently, Amazon got Avengers: Infinity War directors Joe and Anthony Russo to create a new series. The Walt Disney Company’s (DIS) DTC (direct-to-consumer) concept to deliver video services to its customers may further increase competition.

Impact on subscriber growth

All the competition is hurting Netflix’s membership growth. In fiscal Q2 2018, it missed its subscriber guidance for the first time.

Competition for Netflix exists in the international markets as well. Some French broadcasters are teaming up to produce original series. In Germany, Amazon Prime holds 30.4% of the market share against Netflix’s 21.45%, according to research firm Goldmedia.

Netflix is currently targeting the highly-populated Indian market to offset its lower subscriber growth. However, both Amazon and Hotstar (FOXA) already have a strong foothold in that market. Both offer services for about $2 per month compared to Netflix’s $10 per month.