How Nike Stock Has Performed in 2018

Nike (NKE) delivered a strong performance in the stock market during 2017 with a 23% rise during the year.

March 21 2018, Updated 7:31 a.m. ET

Stock market performance

Nike (NKE) delivered a strong performance in the stock market during 2017 with a 23% rise during the year. Competitors Lululemon Athletica (LULU) and Columbia Sportswear (COLM) also rose more than 20% during the year, while Under Armour (UAA) plunged around 50%.

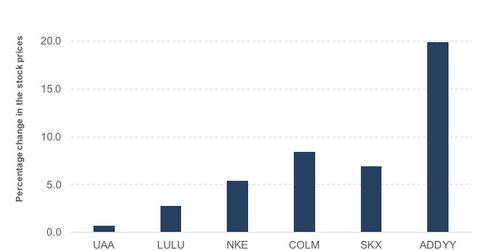

Nike is on an upward trajectory so far this year and has soared more than 5%, outperforming the S&P 500 Index, which has returned 2.2%. It has also done better than Lululemon Athletica and Under Armour, which have risen 2.8% and 0.7%, respectively. Columbia Sportswear (COLM) and Sketchers (SKX) have been the outperformers and have risen 8% and 6% YTD (year-to-date), respectively.

Is there any upside to Nike stock?

Nike is currently trading at $65.71, 6.5% below its 52-week high price. Wall Street expects a 4% jump to $68.68 over the next 12 months. The company, which is covered by 36 Wall Street analysts, is rated a 2.3 on a scale where one is a “strong buy” and five is a “strong sell.” 58% of the analysts covering Nike suggest a “buy,” 36% suggest a “hold,” while the remaining 6% have a “sell” rating.

Credit Suisse recently initiated coverage on Nike with an “outperform” rating. Analyst Michael Binetti believes that the company’s revenue growth bottomed during 1Q18 and that growth should accelerate at a high-single-digit rate during the next fiscal year. Improved basketball sell-through, innovation in running, strong World Cup-related international sales, and diminishing sales headwinds in the US should drive this growth.

“We think Nike, with revenues accelerating and naturally reversing margin headwinds driving upside to Consensus, will continue to trade at a premium to peers,” commented Binetti on March 13.

Binetti has set a price target of $78 on the company, which indicates an upside of 18% on yesterday’s share price.