Apple’s Valuation Increased by $140 Billion in August

Recently, Apple (AAPL) stock breached a valuation of $1 trillion and became the first public company to reach the landmark.

Aug. 30 2018, Published 1:15 p.m. ET

Apple had a blockbuster month

Recently, Apple (AAPL) stock breached a valuation of $1 trillion and became the first public company to reach the landmark.

Apple has experienced a stellar rally and added a market cap of $60 billion. In August, the stock rose ~17% and added a market cap of $140 billion.

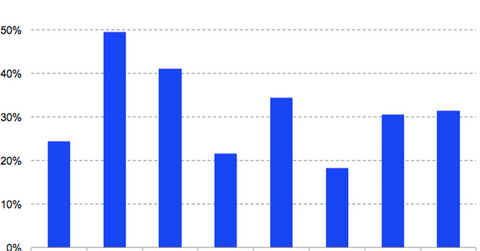

The rally came after the company’s decent third fiscal quarter results. While the company’s iPhone unit sales remained sluggish, iPhone X’s higher price led to ~20% growth in Apple’s revenues year-over-year. The 31% growth in Apple’s Services segment, which will likely be the engine for its future growth, buoyed the markets.

Apple depends on its Services segment

Apple stock is still relatively cheap. The stock is trading at 19.8x its 2019 earnings. The stock is especially cheap compared to some of the other FAANG stocks.

However, Apple’s slowing iPhone unit sales growth has concerned investors. While iPhone X’s lofty prices have led to decent iPhone revenue growth, the company can’t keep increasing its selling prices.

However, Apple’s Services segment, which will include its content push soon, could make up for the sluggish iPhone growth. Currently, the segment accounts for 13% of Apple’s total revenues.

Apple’s stock has risen nearly 30% in 2018. Most of the gains came after the company announced its quarterly financial numbers.