Analyzing Caterpillar’s Resource Industries Segment

Caterpillar’s Resource Industries segment is the company’s lowest revenue contributor. The segment had a revenue share of 18% in the second quarter.

Aug. 3 2018, Updated 9:01 a.m. ET

Resource Industries segment

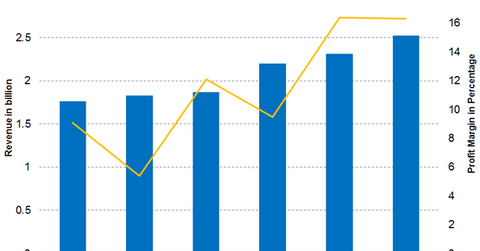

Caterpillar’s (CAT) Resource Industries segment is the company’s lowest revenue contributor. The segment had a revenue share of 18% in the second quarter. The segment’s revenue share increased by 1.8 percentage points on a YoY (year-over-year) basis. The segment reported revenues of $2.52 billion in the second quarter, which implies an increase of 37.6% on a YoY basis. In the second quarter of 2017, the segment reported revenues of $1.83 billion.

The segment’s revenue growth was driven by the demand for equipment across all of the regions. The increase in mining investment triggered the mining activities, which resulted in higher equipment sales. However, Caterpillar thinks that mining customers haven’t fully started their fleet replacements, which indicates that the segment will likely see more demand going forward. The increased mining activity led to higher aftermarket parts sales. Favorable price realization also drove the revenue growth.

On a geographical basis, Asia led the pack with 47% growth. The EMEA (Europe, Middle East, and Africa) region grew 44%, Latin America grew 32%, and North America grew 31%.

Operating profit and margin

The Resource Industries segment reported an operating income of $411 million in the second quarter compared to $99.0 million in the second quarter of 2017—an increase of 315% YoY. The segment reported an operating profit margin of 16.3% in the second quarter—compared to 5.4% in the second quarter of 2017—an increase of 10.9 percentage points YoY. The segment’s operating profit and margin increased due to the higher sales volume and better price realizations.

Investors can hold Caterpillar indirectly by investing in the SPDR SSGA Gender Diversity Index ETF (SHE), which has invested 2.0% of its portfolio in Caterpillar. The fund also provides exposure to Johnson Controls (JCI), Northern Trust (NTRS), and Stanley Black & Decker (SWK) with weights of 0.8%, 0.6%, and 0.5%, respectively, as of July 31.