The Rally in Emerging Market Debt

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.

Sept. 30 2016, Published 4:33 p.m. ET

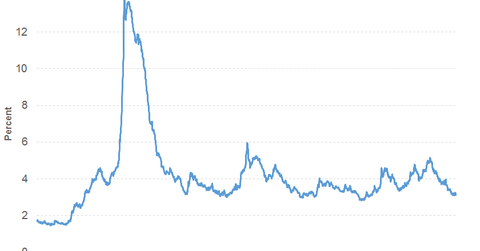

The first thing that jumps out at me from this Bloomberg data is the continued search for yield. Investors have put money into investment grade corporate bonds and emerging markets—two sectors that have historically provided above average levels of income compared to other fixed income segments. This isn’t really a surprise given how low yields are in the market. It is increasingly difficult to generate income in a bond portfolio, driving many investors to seek out new sources of income. Investment grade corporate bonds and emerging market debt have benefited from this trend for most of 2016.

Market Realist –Emerging market debt leads the way

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016. According to the Institute for International Finance, emerging market corporate debt rose $1.6 trillion in the first half of the year. Demand for emerging market debt has been driven by higher yields due to the low and negative bond yields of developed economies.

China, Saudi Arabia, and Poland were the prime issuers of debt. Low inflation has acted as a boon by hindering the interest rate and instigating further monetary easing from the central banks of Europe, Japan, and England.

We can see how gross returns generated by the MSCI Emerging Market Index have exceeded those of the MSCI World Index. The MSCI World Index includes only developed markets, and the MSCI ACWI Investable Market Index includes both developing and emerging market countries.

Investors have put more than $16 billion into dollar-denominated emerging market bond funds since the United Kingdom voted in favor of a Brexit. As a result, bond prices rose significantly, bringing down the cost of borrowing and thus spurring demand. This scenario has also triggered the demand for local currency bonds, which remain vulnerable to credit risk and currency fluctuations.

JPMorgan Chase has projected that debt sales of the dollar-denominated and euro-denominated emerging markets will breach the $125 billion mark due to Saudi Arabia’s debut in the arena.

The average emerging-market fund generated a 12-month yield of 4.3% compared to 1.9% by the average US government intermediate-term bond fund. The dollar denomination of emerging-market debt funds, apart from eliminating currency risks, also gives liquidity to bonds. However, concerns will always remain in terms of the stability of developing economies and the time it will take for low interest rates to sustain.

Let’s look at some year-to-date returns for ETFs: