What Drives Microsoft’s Average Revenue per User

Microsoft’s (MSFT) ARPU (average revenue per user) growth has continued to improve, buoyed by strong demand for its Office 365 and Azure products and Xbox Live monthly active users.

June 27 2018, Updated 7:31 a.m. ET

Cloud demand remains a key catalyst

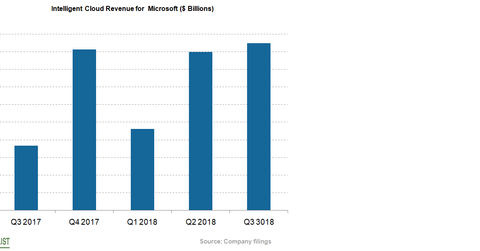

Microsoft’s (MSFT) ARPU (average revenue per user) growth has continued to improve, buoyed by strong demand for its Office 365 and Azure products and Xbox Live monthly active users. Organizations’ ongoing trend of migrating their on-premises database to the cloud has created an opportunity for Microsoft’s Azure cloud business and grown its ARPU. The company’s Azure cloud platform provides flexibility to clients by offering a public, private, and hybrid cloud structure. As the cloud space is dominated by four key players—Amazon (AMZN), Microsoft (MSFT), Google (GOOGL), and IBM (IBM), competition is intense. The graph above shows Microsoft’s intelligent cloud revenue growth over the last five quarters.

Office 365 driving ARPU

As mentioned, Microsoft’s Office 365 product suite, which comprises three levels (E1, E3, and E5), drives the company’s ARPU growth. Nearly 40% of its customer base is below the E3 level, providing a huge ARPU growth opportunity. The company’s premium E5 product suite emphasizes security features that may draw clients from the E1 and E3 categories, boosting the company’s ARPU. The GDPR (General Data Protection Regulation), implemented in Europe as of May, may also boost demand for the company’s E5 Office 365 suite.

Other drivers

Microsoft’s policy to build a unified communication platform by integrating iSkype with other services may act as a catalyst for ARPU growth, as well as the company’s focus on emerging markets and small and medium businesses.