Under Armour: Inventory Management in Focus

Inventory backlog has been a critical pressing issue for Under Armour (UAA) for some time.

June 20 2018, Updated 8:09 a.m. ET

Inventory: A key headwind for UAA

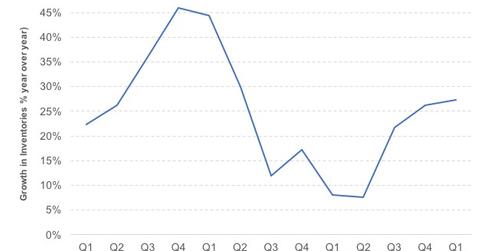

Inventory backlog has been a critical pressing issue for Under Armour (UAA) for some time. The levels soared a massive 22% YoY (year-over-year) during the third quarter of 2017 as the company struggled to get its products to wholesalers on time. Inventories have grown at an increasing rate since then and rose ~27% YoY during the first quarter of 2018, which ended on March 31.

Under Armour’s inventory turnover is the lowest among its close competitors. The company recorded an inventory turnover ratio of 2.6 for fiscal 2017. In comparison, sportswear competitors Nike (NKE) and Lululemon Athletica (LULU) recorded inventory turnover ratios of 3.8x and 4.0x, respectively, in their recent fiscal years.

Inventory turnover is calculated by dividing the cost of goods sold with inventory levels. A low inventory turnover ratio indicates that a company is carrying too much inventory. A high inventory turnover ratio is reflective of the company’s strong inventory management capabilities.

Analysts mention inventory cleanup

UAA is working on cleaning up its inventory backlog. Jefferies analyst Randal Konik recently mentioned that UAA is focusing on cleaning up its inventories. Konik said,”While we acknowledge that inventory was elevated exiting first-quarter, we believe it continues to get cleaner.”

Dick’s Sporting Goods (DKS), one of Under Armour’s important retailers, recently mentioned improving its inventory position. “The majority of the inventory has been cleaned up,” said Edward Stack, CEO of Dick’s, in a recent conference call. Stack also talked about Under Armour during the call and said, “We are really pleased with the content and the direction we’re going to be going with them going forward.”

The cleanup could boost Under Armour’s margins and add value to its bottom line. Let’s look at that more in the next part.