Kimberly-Clark’s Dividend Growth

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment.

Aug. 16 2017, Updated 11:53 a.m. ET

Kimberly-Clark: Consumer goods sector, personal products industry

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment; namely, Personal Care, Consumer Tissue, and Kimberly-Clark Professional. Lower operating expenses contributed to a substantial growth in its operating income and EPS (earnings per share) despite higher interest expenses. The company always generates enough free cash flow to pay off its dividends. It also participates in share repurchases. The company currently has a high financial leverage and debt-to-equity ratio.

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment; namely, Personal Care, Consumer Tissue, and Kimberly-Clark Professional. Lower operating expenses contributed to a substantial growth in its operating income and EPS (earnings per share) despite higher interest expenses. The company always generates enough free cash flow to pay off its dividends. It also participates in share repurchases. The company currently has a high financial leverage and debt-to-equity ratio.

The company expects its Global Business Plan strategies to lead to an organic sales growth of 2.0% and EPS of $6.20–$6.35 in 2017.

The company’s dividend yield has recorded growth over the years, as you can see in the graph below. (Note that the asterisk in the graph denotes an approximation in calculating the dividend.)

Net sales

Kimberly-Clark’s net sales fell marginally in the first half of 2017 due to a decline in its Consumer Tissue segment. That led to a marginal fall in operating income and flat EPS following higher interest expenses.

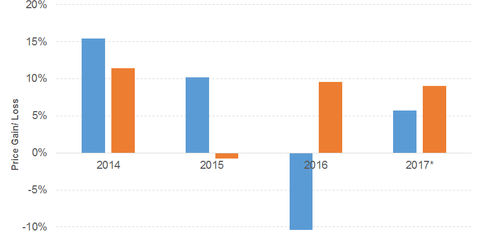

Prices have started moving north after the slump in 2016. However, we can see the irregularities in the price movement in 2017 after the peak in February. (Note that the asterisk in the graph denotes the price gain or loss to date.) The company has acknowledged the challenging economic environment and intense competition from companies such as Procter & Gamble (PG) and Unilever. Like its peers, Kimberly-Clark is focused on trimming costs.

KMB stock has risen 5.3% on a YTD (year-to-date) basis.

Kimberly-Clark’s PE (price-to-earnings) ratio of 20.1x compares to a sector average of 14.1x. The company’s dividend yield of 3.2% compares to a sector average of 1.6%.

The PowerShares International Dividend Achievers ETF (PID) has a dividend yield of 3.7% at a PE ratio of 15.1x. It has the highest exposure to financials. The ProShares S&P 500 Dividend Aristocrats (NOBL) has a dividend yield of 1.9% at a PE ratio of 21.0x. It has the highest exposure to consumer goods.