Gold’s Outlook for 2018

Looking ahead for 2018, industry analysts stated in a Bloomberg article that they expect gold to perform better early in the year led, by the “January effect.”

Jan. 29 2018, Published 2:24 p.m. ET

VanEck

Based on the gold price strength following December rate increases in 2015 and 2016, we expect to see firmness in the gold price in the first quarter. However, headwinds may come for gold if economic growth enables the Fed to tighten more than expected. Also, the U.S. dollar might strengthen if the new tax code causes corporations to repatriate profits stockpiled overseas. We believe any weakness in gold during the first half of 2018 could be transitory. Moving through 2018 and into 2019, we believe the chance of an economic downturn increases, along with the probability of a significant decline in the markets. High levels of debt could cause a downturn to turn into a financial crisis. We now know that quantitative easing [2. Quantitative Easing by a central bank increases the money supply engaging in open market operations in an effort to promote increased lending and liquidity] and below-market rates have failed to generate needed growth or inflation. In the next crisis, look for central banks to resort to even more radical policies, such as directly funding treasuries. It is conceivable that there could be global currency debasement on a scale never seen before. In such a scenario, hard assets, especially gold and gold stocks, could significantly outperform most, if not all, other asset classes in our opinion. There comes a time in every economic cycle when investors should seek portfolio insurance. We believe the time is now.

Market Realist

Outlook for gold in 2018

Looking ahead for 2018, industry analysts stated in a Bloomberg article that they expect gold to perform better early in the year led, by the “January effect.” Economic expansion could lead to higher inflation, which has usually proven advantageous for gold prices.

Empirical records show that, on average, gold has delivered positive returns during the first quarter of a year. In the Bloomberg report, Bank of America Merrill Lynch reflects a bleak outlook for gold and sees limited room for an increase in gold prices, owing to the challenging macroeconomic outlook.

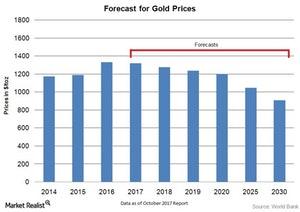

On the other hand, Goldman Sachs, the Toronto-Dominion Bank, and the Canadian Imperial Bank of Commerce (or CIBC) expect a seasonal rally for gold in the first quarter of 2018. Morgan Stanley expects gold prices to get a boost from a weak US dollar, but it also projects a Fed rate hike cycle to weigh down gold prices. The firm estimates gold prices will average $1,269 per ounce in 2018. In its “Commodity Market Outlook” for October 2017, the World Bank projects gold prices to drop 1% in 2018.

If the stock markets continue to rally, supporting economic growth across major economies along with Fed rate hikes, these factors could be headwinds for gold prices. Gold investments can take the form of physical gold or gold stocks like Eldorado Gold (EGO), New Gold (NGD), and Franco Nevada (FNV). Other options include the VanEck Vectors Gold Miners ETF (GDX), which provides exposure to the gold mining industry tracked by the NYSE Arca Gold Miners Index.