Comparing VMware’s Valuations with Its Peers

On May 22, VMware’s (VMW) market capitalization stood at $55.4 billion.

June 1 2018, Updated 7:32 a.m. ET

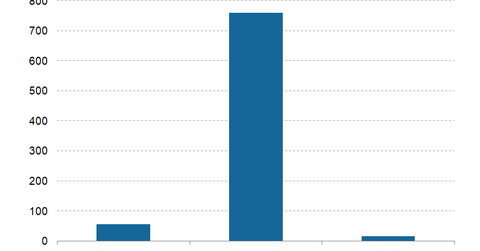

Peer comparison based on market capitalization

On May 22, VMware’s (VMW) market capitalization stood at $55.4 billion. The market capitalization of its IT peer Citrix (CTXS), supporting virtualization, stood at ~$14.3 billion.

VMware’s valuation metrics

On May 22, VMware was trading at a forward EV-to-EBITDA multiple of ~13.6x. In contrast, Citrix had a forward EV-to-EBITDA multiple of ~14.2x.

On May 22, VMware was trading at a forward PE (price-to-earnings) multiple of ~20.6x. On the same date, Citrix had a forward PE multiple of ~18.3x.

Bollinger Band

In the May 29 trading session, VMware stock closed at $136.80, close to its lower Bollinger Band level of $129.00. This value indicates that the stock is oversold, and investors could take it as a “buy” signal.

Short interest ratio

On May 22, VMware’s short interest as a percentage of its shares outstanding (or short interest ratio) was ~7.8%. Generally, a stock’s short interest ratio that is greater than 40.0% implies that the investors and the traders expect the company’s stock price to decline.

Stock returns

In the last year, VMware’s stock price gained 42.5%, and it rose 0.1% in the last month. The company’s stock price has declined 3.3% in the last five days.