Synergies of the GE Transportation and Wabtec Deal

The deal between General Electric (GE) and Wabtec (WAB) is expected to generate annual run-rate synergies of $250 million by 2022.

May 28 2018, Updated 10:32 a.m. ET

Deal synergies

The deal between General Electric (GE) and Wabtec (WAB) is expected to generate annual run-rate synergies of $250 million by 2022 due to lower costs and higher revenues. As we’ve already seen in this series, tax benefits with a net present value of $1.1 billion are expected to accrue to the combined entity. Higher margins and strong cash flow of the combined business could result in 15% cash EPS accretion in the first year after the deal closes.

After completing the transaction, Wabtec will have $8 billion in revenues. With an estimated employee base of 27,000, the combined entity will operate in 50 countries. It will have a more diversified business mix along with increased operating margins.

Other synergies

Transportation (IYT) is essentially a cyclical industry. Currently, railroad industry (CSX) fundamentals are sort of subdued. However, growth is in the cards for 2018. Both companies should benefit from the cyclical tailwinds with a turnaround in conditions for the rail sector (TRN).

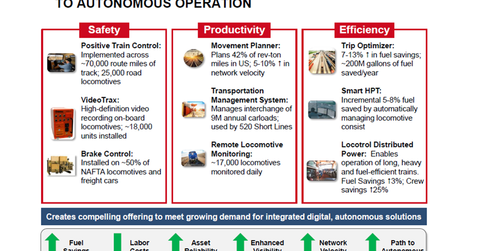

GE’s and Wabtec’s complementary businesses, as well as their huge installed bases worldwide, should generate additional opportunities for aftermarket service growth, cross-selling, and new solutions. GE Transportation has been witnessing a reduction in parked locomotives, and Wabtec has noted the same.

GE Transportation financial assumptions

GE Transportation is hoping for a solid rebound in the upcoming quarters. Its estimated adjusted EBITDA is slated to grow to $750 million in 2018 and to $900 million–$1 billion in 2019. GE Transportation’s revenue and adjusted EBIT[1. earnings before interest and tax] is anticipated to rise at a double-digit CAGR (compound annual growth rate) from 2017A to 2019E as the cycle regains from the earlier low levels.

According to GE, 50% of the Transportation segment’s estimated total revenue in 2018–2020 is already in backlog, amounting to $18 billion. This backlog by quantity includes ~1,800 new locomotives and a backlog of ~1,000 locomotives to be modernized. Locomotive deliveries are expected to grow in line with recent orders. The segment has received $3.6 billion in orders in the last two quarters.

In the next part of this series, we’ll take a look at GE’s strategic rationale to merge its Transportation segment with Wabtec.