What’s behind Target’s Stellar Traffic Growth in Q1 2018?

Target (TGT) sustained its sales momentum in the fiscal first quarter. The company’s growth measures have started to hold ground.

Aug. 18 2020, Updated 5:14 a.m. ET

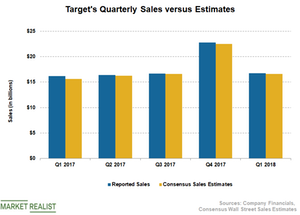

Sales exceed expectations

Target (TGT) sustained its sales momentum in the fiscal first quarter. The company’s growth measures have started to hold ground. Target’s total sales of $16.8 billion exceeded analysts’ expectation of $16.6 billion and increased 3.4% YoY (year-over-year) due to improving comps.

Target’s comparable store sales or comps grew 3.0% in the fiscal first quarter, which reflected 3.7% growth in traffic—the highest in the past ten years. However, negative weather conditions remained a drag with the average ticket size declining 0.6%. The company’s digital sales jumped 28.0% in the first quarter and contributed 1.1% to the comps growth rate.

In comparison, Walmart’s (WMT) comps in the US have also been benefiting from higher digital sales. Walmart’s traffic continued to improve following store remodels and consumer-friendly initiatives. Meanwhile, Costco (COST) continues to outperform Target and Walmart with its stellar comps led by higher membership renewal rates and value proposition.

Remodeling stores at an accelerated pace, opening new small-format stores, and launching exclusive brands are driving Target’s traffic higher. A strong digital push with same-day delivery through Shipt, the expansion of the Restock program, and Drive-Up services also drove the traffic.

Outlook

Given the strength in the traffic, Target’s management expects fiscal second-quarter comps to mark low to mid-single-digit growth. The fiscal comps are also expected to improve on a YoY basis despite tough comparables in upcoming quarters. An anticipated increase in warm weather categories, exclusive brands, store remodeling, and expanded delivery services will likely drive Target’s traffic and its comps.