What Will Drive Wendy’s Revenue in Q1 2019?

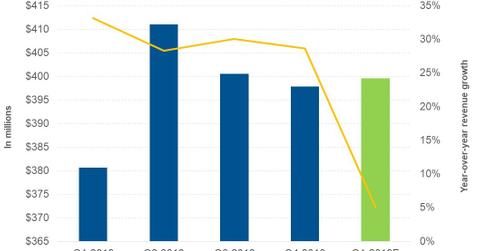

Analysts expect Wendy’s (WEN) to post adjusted EPS of $399.5 million in the first quarter of 2019, a rise of 5.0% from its $380.6 million in the first quarter of 2018.

April 30 2019, Published 2:20 p.m. ET

First-quarter revenue

Analysts expect Wendy’s (WEN) to post adjusted EPS of $399.5 million in the first quarter of 2019, a rise of 5.0% from its $380.6 million in the first quarter of 2018. New restaurants and positive SSSG (same-store sales growth) are expected to drive the company’s revenue during the quarter.

By the end of 2018, Wendy’s operated 16 more company-owned restaurants and 62 more franchised restaurants compared to restaurants operated at the end of the first quarter of 2018. The net addition of these restaurants, along with restaurants opened in the first quarter of 2019, is expected to drive the company’s revenue.

Wendy’s has been focusing on expanding its delivery service, reimaging its restaurants, digital advancements, menu innovations, and improving the quality of its menu items to drive its same-store sales growth or SSSG.

In association with DoorDash and Skip The Dishes, Wendy’s was offering delivery service from 60% of its North American restaurants at the end of 2018. The company plans to expand the service to 80% of North American restaurants by the end of this year.

On the fourth-quarter earnings call, the company announced to invest $25 million on strengthening its digital capabilities. The company has started rolling out mobile ordering in its US restaurants and expects all its US restaurants to have activated mobile ordering by the end of this year.

In the first quarter of 2019, the company introduced the $5 Giant Jr. Bacon Cheeseburger and Made to Crave hamburger line. Along with these new menu items, various marketing and promotional initiatives are expected to drive SSSG during the quarter.

Peer comparisons and outlook

During the comparable quarter, Restaurant Brands International (QSR) has posted revenue growth of 1.0% while analysts are expecting Jack in the Box (JACK) and McDonald’s (MCD) to post revenue growth of 3.8% and -4.0%, respectively.

For 2019, analysts expect Wendy’s to post revenue of $1.67 billion, which represents a rise of 5.0% from $1.59 billion in 2018.