How Hyperscalers Impact Growth in the Server Market

Hyperscalers drove volume demand in the server market Earlier, we discussed growth in the server market, wherein the high-end segment benefited from the launch of IBM’s (IBM) z14 mainframe. According to Sanjay Medvitz, a senior research analyst at IDC, “ODMs [original device manufacturer] continue to be the primary beneficiaries from hyperscale server demand. Some OEMs […]

May 3 2018, Updated 7:32 a.m. ET

Hyperscalers drove volume demand in the server market

Earlier, we discussed growth in the server market, wherein the high-end segment benefited from the launch of IBM’s (IBM) z14 mainframe.

According to Sanjay Medvitz, a senior research analyst at IDC, “ODMs [original device manufacturer] continue to be the primary beneficiaries from hyperscale server demand. Some OEMs [original equipment manufacturer] are also finding growth in this area, but the competitive dynamic of this market has also driven many OEMs such as HPE to focus on the enterprise.”

ODMs have been eating up the market shares of larger players such as Hewlett Packard Enterprise (HPE), Dell EMC, IBM, and Cisco Systems (CSCO) due to the growing interest of hyperscale players such as Amazon (AMZN), Facebook (FB), and Google (GOOG).

Medvitz said, “Hyperscalers remained a central driver of volume demand in the fourth quarter with leaders such as Amazon, Facebook, and Google continuing their datacenter expansions and updates.”

Hyperscalers invest in capital expenditure

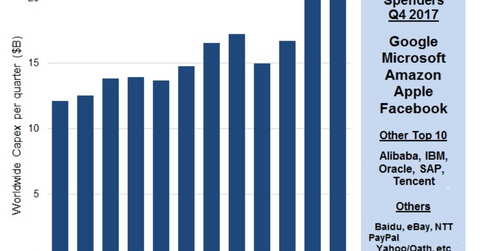

The above presentation by Synergy Research Group shows that the capex of hyperscale operators Google, Microsoft, Amazon, Apple, and Facebook (FB) totaled $22 billion in 4Q17 and reached almost $75 billion in 2017.

On average during 2017, these players collectively spent more than $13.0 billion per quarter. On a year-over-year basis, this hyperscale capital expenditure, which goes toward developing and expanding data centers, rose 19.0%.