How McDonald’s Is Expanding Its Business

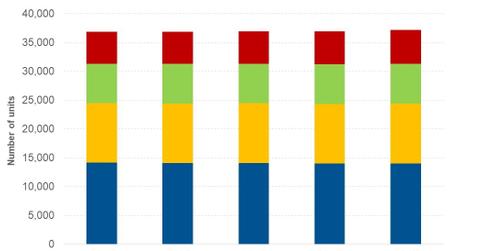

By the end of 4Q17, McDonald’s (MCD) operated 37,241 restaurants, which includes 3,133 company-owned restaurants and 34,108 franchised restaurants.

Jan. 31 2018, Published 2:06 p.m. ET

Current operations

By the end of 4Q17, McDonald’s (MCD) operated 37,241 restaurants, which includes 3,133 company-owned restaurants and 34,108 franchised restaurants. In the last four quarters, the company increased the unit count of its franchised restaurants 2,878 units while the unit count of company-owned restaurants declined by 2,536.

Unit growth across segments

United States: By the end of 4Q17, the segment operated 14,036 units, which includes 887 company-owned restaurants and 13,149 franchised restaurants. During the last four quarters, the segment’s overall unit count has declined by 119 units, with the unit count of company-owned restaurants declining by 222 units. The unit count of franchised restaurants increased by 103 units.

International Lead Markets: This segment increased its overall unit count by 70 units to 6.921 restaurants in 4Q17, compared to 6,851 units in 4Q16. During the period, the unit count of franchised restaurants increased by 214 units to 5,998 while the unit count of company-owned restaurants declined by 144 units.

High-Growth Markets: The segment overall operated 5,884 restaurants by the end of 4Q17, which includes 1,141 company-owned restaurants and 4,743 franchised restaurants. In the last four quarters, the overall unit count for the segment increased by 332 units with the unit count of franchised restaurants rising by 2,075 while the unit count of company-owned restaurants declined by 1,763.

Foundational Markets: By the end of 4Q17, the segment operated 10,400 restaurants with 182 company-owned restaurants and 10,218 franchised restaurants. In the last four quarters, the company increased the unit count of franchised restaurants by 466 units while the unit count of company-owned restaurants declined by 407 units.

Peer comparisons

During the same period, Starbucks (SBUX) increased its unit count by 2,305 units to 28,309 restaurants.

Next in this series, we’ll look at McDonald’s EBIT (earnings before interest and tax) margins.