Germany Services PMI: Why It’s Falling Gradually

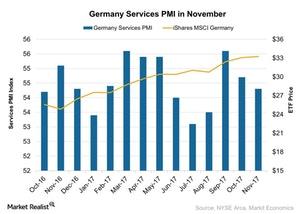

The final Markit Germany Services PMI was 54.3 in November compared to 54.7 in October. It didn’t beat the preliminary market estimate of 54.9.

Dec. 14 2017, Updated 12:40 p.m. ET

Germany Services PMI in November

According to data provided by Markit Economics, the final Germany Services PMI (Purchasing Managers’ Index) was 54.3 in November compared to 54.7 in October. It didn’t beat the preliminary market estimate of 54.9.

The Germany Services PMI included the following:

- Production output showed stronger improvement in November 2017.

- New business orders improved at a marginally slower rate in November than in October.

- Employment in the services sector rose moderately in November.

ETF performances in November

The iShares MSCI Germany ETF (EWG), which tracks Germany’s economic performance, rose 0.5% in November 2017. The iShares MSCI Germany Small-Cap (EWGS), which tracks the performance of Germany’s small-cap stocks, rose 1.7% in November.

The gradual fall in the Germany (DAX-INDEX) Services PMI is mainly due to the gradual fall in overseas client demand. However, the business condition for the services sector remained strong in November. Major sectors of the services industry such as financial services, transportation, and other services showed strong improvement. However, hotels and restaurants contracted, which hampered the overall performance in November.

In the next part of this series, we’ll analyze the performance of the France Services PMI for November 2017.