Comparing Cannabis Stocks’ EV-to-EBITDA Multiples

In this part, we’ll compare how these producers’ multiples compare with each other.

Nov. 20 2020, Updated 5:02 p.m. ET

Comparing multiples

In the previous part of this series, we discussed how Canadian cannabis stocks’ (HMMJ) forward EV-to-EBITDA (enterprise value-to-earnings before interest, tax, depreciation, and amortization) multiple moved last week. In this part, we’ll compare how these producers’ multiples compare with each other.

Forward EV-to-EBITDA

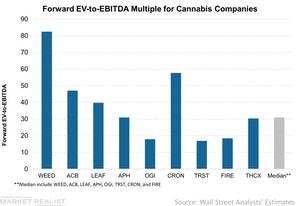

As the above chart shows, the peer median forward EV-to-sales ratio was 30.9x in the week ended May 11. The median has averaged 37.8x in the last year. Aphria (APH) (APHQF) was trading right at the median of 30.9x but below its one-year average of 36.9x.

The companies that were trading above the median include Canopy Growth (WEED), which was trading at 82.5x versus its one-year average of 130.5x. Cronos (CRON) was trading at 57.7x, which was below the company’s historical average of 83.3x over the last year. Aurora Cannabis (ACB) (ACBFF) was trading at 47.1x compared to its one-year average of 36.9x, followed by MedReleaf (LEAF), which was trading at 39.8x, below its average of 34.4x since inception in June last year.

Hydropothecary, Supreme Cannabis, Organigram, and CannTrust were all trading below the peer median. Hydropothecary (THCX) was trading at 16.9x, which was below its one-year average of 25x. Supreme Cannabis (FIRE) was trading at 18.4x, also below its one-year average of 33.1x. Organigram (OGI) (ORGMF) was trading at 17.9x, below its one-year average of 21.5x. CannTrust (TRST) was trading at 16.9x, below its average of 25.0x since August last year.