American Tower Is Trading at High Multiples amid Global Expansion

American Tower (AMT) is currently trading at a trailing-12-month price-to-FFO ratio of 20.2x.

May 14 2018, Updated 10:30 a.m. ET

Price to funds from operation

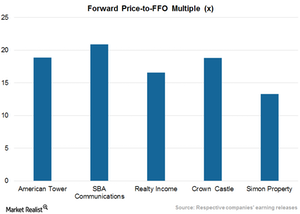

REITs are usually valued using price-to-FFO multiples, since this ratio requires adding back depreciation and makes other adjustments that help in correctly determining a REIT’s income. American Tower (AMT) is currently trading at a trailing-12-month price-to-FFO ratio of 20.2x compared with its peer group average of 18.7x, which suggests that the company is being traded at a premium compared to its peers. Players in the peer group include Crown Castle (CCI), SBA Communications (SBAC), Realty Income (O), and Simon Property Group (SPG).

On the basis of 2018 projections, American Tower has a forward 12-month price-to-FFO ratio of 18.9x. The forward 12-month price-to-FFO multiples of competitors are as follows:

- Crown Castle: 18.8x

- Realty Income: 16.6x

- Simon Property: 13.3x

- SBA Communications: 20.9x

Thus, American Tower is being traded at a premium compared to Crown Castle, Realty Income, and Simon Property. The company is being traded at a discount compared to SBA Communications.

American Tower is being traded at a premium compared to its peer group average of 17.4x on the back of its strong fundamentals, solid underwriting results, effective brand management, efficient capital allocation, and robust inorganic growth. The company’s rising efforts to streamline its business, minimize its business risks, and sharpen operational excellence are likely to support the stock price going forward.

Enterprise value to earnings before interest, taxes, depreciation, and amortization

Since REITs are heavily financed with debt, this enterprise value multiple provides a clearer picture of a company’s valuation to investors.

On the basis of this multiple, American Tower is currently being traded at a trailing 12-month EV-to-EBITDA of 20.2x. The company also has a forward 12-month EV-to-EBITDA ratio of 20.9x.

The forward 12-month EV-to-EBITDA multiples of its competitors are as follows:

- Crown Castle: 24.5x

- Realty Income: 19.1x

- Simon Property: 17.5x

- SBA Communications: 23.3x

From this perspective, while American Tower is being traded at a discount in comparison to Crown Castle and SBA Communications, it trades at a premium over Realty Income and Simon Property.

American Tower makes up ~9.8% of the Real Estate Select Sector SPDR Fund (XLRE).

In the next article, we’ll discuss how Wall Street analysts have rated American Tower.