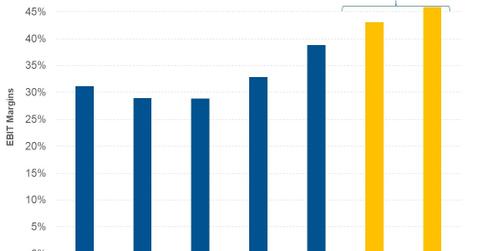

Why McDonald’s EBIT Margin Expanded in 2018

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%.

April 6 2018, Updated 9:02 a.m. ET

EBIT margin

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%. Comparatively, the company had posted an EBIT margin of 32.8% in 2016.

The expansion of the company’s EBIT margin was driven by increased revenues from franchised restaurants, as well as lower company-owned restaurant expenses and franchised restaurants-occupancy expenses as a percentage of total revenues. However, some of the expansions were offset by higher SG&A (selling, general, and administrative) expenses.

The restaurant expenses of company-owned restaurants declined from 83.0% in 2016 to 81.8%. The sales leverage from positive SSSG more than offset the negative effects of an increase in commodity and labor costs, as well as an increase in depreciation costs due to the implementation of EOTF (Experience of the Future).

The franchised restaurants’ occupancy expenses declined from 18.4% in 2016 to 17.7% in 2017. The expansion was due to sales leverage from positive SSSG, which was partially offset by refranchising and higher occupancy costs.

The SG&A expenses increased from 9.7% in 2016 to 9.8% in 2017 due to an increase in technology-related spending. However, some of the expenses were offset by lower employee-related costs.

Peer comparisons

In 2017, Wendy’s (WEN), Jack in the Box (JACK), and Restaurant Brands International (QSR) have posted EBIT margins of 23.0%, 16.8%, and 42.4%, respectively.

Outlook

Analysts expect McDonald’s to post EBIT margins of 43.1% and 45.9% in 2018 and 2019, respectively. The expansion is expected to be driven by the refranchising of company-owned restaurants. In the long run, the company’s management expects its operating margin to be in the mid-40% range.

Next, we’ll look at McDonald’s earnings per share in 2017.