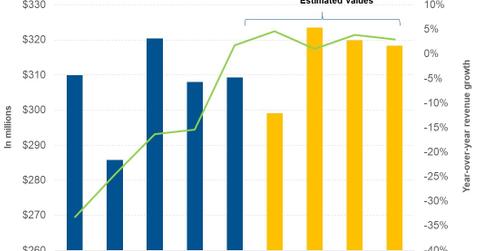

What Analysts Expect for Wendy’s Revenue in 2018

For 2018, analysts are expecting Wendy’s (WEN) to post revenue of $1.3 billion, which represents a growth of 2.6%.

Feb. 27 2018, Updated 7:32 a.m. ET

2018 expectations

For 2018, analysts are expecting Wendy’s (WEN) to post revenue of $1.3 billion, which represents a growth of 2.6% from $1.2 billion in 2016. Revenue growth is expected to be driven by the addition of new restaurants and positive SSSG (same-store sales growth). The company’s management expects to increase its global unit count by 2% in 2018 and post SSSG of 2%–2.5% in North America.

Wendy’s continues to focus on menu innovations, image activation, and the implementation of technological advancement to drive SSSG. Since the beginning of 1Q18, it has expanded its 4 for $4 Meal Deal menu to include eight entrées, and it introduced its Smoky Mushroom Bacon Cheeseburger. The company expects to image activate 10% of its restaurants in 2018, which is expected to contribute 0.6% to SSSG of its restaurants in North America. After receiving favorable feedback on its delivery service, the company is planning to expand its delivery service to more restaurants through DoorDash. It’s also planning to partner with other delivery partners to improve the service.

Peer comparisons

During the same period, revenue for McDonald’s (MCD) is expected to fall 7.7%, while Restaurant Brands International (QSR) is expected to post revenue growth of 9.3%.

Outlook

By the end of 2020, Wendy’s management expects to have opened 7,250 restaurants. It expects its global system sales to reach $12 billion. Management expects 70% of its restaurants to have image activation.

Next, we’ll look at Wendy’s 4Q17 EBIT (earnings before interest and tax) margin.