Varian’s HyperArc: Driven by Rising Metastatic Brain Cancer?

Varian Medical Systems’ (VAR) HyperArc is an end-to-end, high-definition, intracranial radiotherapy solution.

April 5 2018, Updated 7:31 a.m. ET

HyperArc performance

Varian Medical Systems’ (VAR) HyperArc is an end-to-end, high-definition, intracranial radiotherapy solution. Since the launch of this radiotherapy solution in 4Q16, the company has secured 57 orders, of which 19 were placed in 1Q18. While it costs almost $2.5 million to install HyperArc on new systems, it takes only $1 million to upgrade the older TrueBeam Eclipse installed base. At the end of 1Q18, more than 60% of the HyperArc orders were related to upgrading older systems.

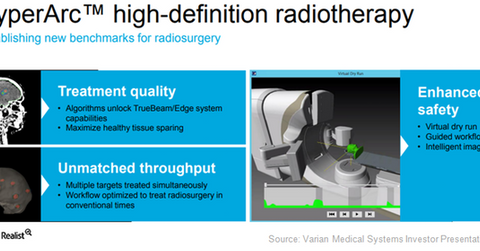

The above diagram highlights the key strengths of the HyperArc system. HyperArc is a key asset in Varian Medical Systems’ portfolio and is enabling the company to be a possible strong competitor for other medical device players such as Abbott Laboratories (ABT), Boston Scientific (BSX), and Becton Dickinson (BDX).

Market opportunity

Varian Medical Systems has projected that by 2022, approximately 15 million patients will be affected by metastatic brain cancer. According to DeSantis CE’s cancer treatment and survivorship statistics for 2014, 20%–40% of those total cancer patients have brain metastases. These factors highlight a growing demand for stereotactic radiosurgery solutions for treating brain metastases. That, in turn, is expected to accelerate the buying of new and the replacement of older radiotherapy systems that will be fitted with the HyperArc solution. Additionally, upgradations of the company’s large TrueBeam Eclipse installed base are expected to be a key driver in increasing the adoption of the HyperArc solution. The company has projected the market opportunity for HyperArc to be $300 million by 2022.

In the next part, we’ll look at the growth prospects for Varian Medical Systems’ treatment planning systems.