Analyzing Delta Air Lines’ Free Cash Flow

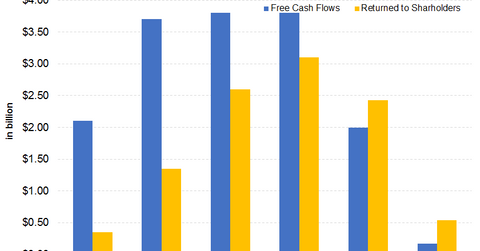

Considering the data in the past five years, Delta Air Lines (DAL) has been generating a strong FCF. Delta Air Lines’ five-year average FCF is $3.08 billion.

June 21 2018, Updated 11:10 a.m. ET

Delta Air Lines’ free cash flow

Considering the data in the past five years, Delta Air Lines (DAL) has been generating a strong FCF (free cash flow). Delta Air Lines’ five-year average FCF is $3.08 billion. In the first quarter, Delta Air Lines’ FCF was $173 million. During the quarter, the company invested $1.2 billion to buy aircraft and make improvements. Delta Air Lines is expected to continue generating strong FCF for the remaining quarters. However, the increased operating cost due to higher oil prices could limit Delta Air Lines’ FCF.

How is the FCF used?

Delta Air Lines’ FCF is mainly used for dividends, share repurchases, expansions, pension plans, and debt repayments. In the past, Delta Air Lines used its strong FCF to reduce its debt from $11.34 billion in 2011 to $7.33 billion in 2016. However, an interesting trend has developed over the past five years. There has been an increase in the percentage of FCF used to return dividends and share repurchases to shareholders.

In 2013, only 16% of the FCF was returned to shareholders. Since then, the percentage has increased. In 2017, Delta Air Lines returned 121.5% of the FCF that it generated. In the first quarter, Delta Air Lines returned 312% of the FCF to shareholders. Currently, Delta Air Lines isn’t looking to repay its debt quickly. The FCF is mainly being used to buy back shares and fund the pension plans.

Investors can hold Delta Air Lines indirectly by investing in the First Trust Nasdaq Transportation ETF (FTXR), which has invested 3.9% of its holdings in Delta Air Lines. The fund also provides exposure to General Motors (GM), FedEx (FDX), and American Air Lines (AAL), which have weights of 8.5%, 8.2%, and 1.9%, respectively, as of June 20.