An Insight into Dick’s Sporting Goods’ Sales Trends

In fiscal 2017, Dick’s Sporting Goods (DKS) reported sales of $8.59 billion, missing analysts’ estimate by just 0.8%.

April 18 2018, Updated 7:34 a.m. ET

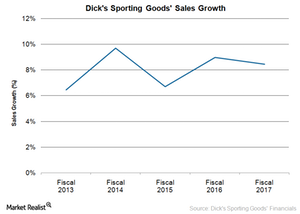

Sales following an uptrend

In fiscal 2017, Dick’s Sporting Goods (DKS) reported sales of $8.59 billion, missing analysts’ estimate by just 0.8%. However, YoY (year-over-year), sales rose 8.4%, primarily driven by a higher store count, digital sales, and sales of private brands. The year’s 53rd week added $105.4 million to revenue.

Comps fell 0.3% YoY as weakness persisted in the hunting and the electronics categories. The company stated that these categories would likely remain pressured in fiscal 2018 as it’s lowering its exposure to them. In fiscal 2018, comps are expected to be either unchanged or decline by low-single digits.

Growth drivers

The company expects its private brands business to strengthen in 2018 as it allocates more store space to brands such as Walter Hagen, Top-Flite, Calia, and Field & Stream. Dick’s said it would also be introducing some new brands. The company reported private brand sales of ~$1 billion in 2017, and it projects to add $1 billion more in revenue in a shorter time frame.

Moreover, the company expects a strong, innovative product pipeline from Adidas, Nike, Callaway, and other sports goods manufacturers to boost its top line in 2018.

The company is also making sound investments in improving its digital and omnichannel capabilities and creating a leaner supply chain network. The company is trying to shorten delivery time for online orders to attract more customers, improving its products page design, and working on a faster checkout process. It has also overhauled its ScoreCard loyalty program, allowing accumulated points to be carried into the next year.

The company remains focused on Dick’s Team Sports HQ. The company believes that this platform has the potential to become a revenue growth driver in the future.

Peers’ performance

In fiscal 2017, Foot Locker (FL) sales rose 0.2% to $7.8 billion. Management expects sales trends to improve in fiscal 2H18, driven mainly by higher premium products sales. In fiscal 2018, Hibbett Sports (HIBB) reported sales of $968.2 million, down 0.5% YoY. The company has continued to focus on digital sales and is optimizing its store portfolio.