Will Colgate-Palmolive Stock Recover?

Colgate-Palmolive (CL) stock is down about 9.6% on a YTD (year-to-date) basis as of March 26, 2018.

March 29 2018, Published 8:06 a.m. ET

What affected Colgate-Palmolive stock?

Colgate-Palmolive (CL) stock is down about 9.6% on a YTD (year-to-date) basis as of March 26, 2018. Much of the decline in its stock price is attributed to the company’s sluggish margin performance during the last reported quarter.

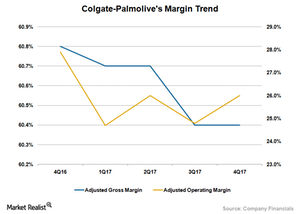

Colgate-Palmolive’s gross and operating margin fell 40 basis points and 190 basis points in 4Q17, reflecting low pricing and increased commodities prices. Higher raw and packaging material costs and increased advertising investments more than offset the benefits from improved volumes and cost savings from its restructuring program. Moreover, pricing pressure in North America and increased competition from local players further remained a drag.

Improving trends

Colgate-Palmolive expects its top line will see mid-single-digit growth in 2018, reflecting higher volumes driven by new product launches. Moreover, increased investments in advertising are likely to support its volume growth. Also, the company expects its adjusted gross profit margins to grow by 50 basis points to 75 basis points in 2018, reflecting improved volumes, higher net price realization, and increased cost savings from its restructuring program.

However, pricing pressure in North America, increased competition, and inflation in raw material and logistics costs are expected to remain a drag. Moreover, the company’s planned increase in advertising spending to support new products and to drive consumption is likely to impact its operating profit margin growth rate adversely.