Why Tech Stocks Have High Price-to-Earnings Ratios

Tech stocks with good growth prospects usually trade at a higher PE (price-to-earnings) ratio than the broader S&P 500, which is why they are considered relatively expensive.

March 2 2018, Updated 7:33 a.m. ET

Rapidly expanding bottom line enables tech stocks to enjoy high PEs

Earlier in the series, we discussed the role of Amazon (AMZN), Microsoft (MSFT), and Netflix (NFLX) on the tech-heavy (QQQ) NASDAQ Composite Index. Tech stocks with good growth prospects usually trade at a higher PE (price-to-earnings) ratio than the broader S&P 500, which is why they are considered relatively expensive. The PE ratio is arrived at by dividing a company’s stock-market valuation with its profits over the TTM (trailing-12-month) period.

Digital evolution and increased adoption of cloud computing have prompted tech companies to participate in SMAC (social, mobile, analytics, cloud), AI (artificial intelligence), IoT (Internet of Things), AR (augmented reality) and VR (virtual reality), blockchain, and other rapidly growing technologies. As a result, tech companies adopting these technologies are able to expand their profits rapidly, which justified the high PE ratio they’re enjoying.

Positive earnings guidance caused the surge in tech stocks as well as their PEs

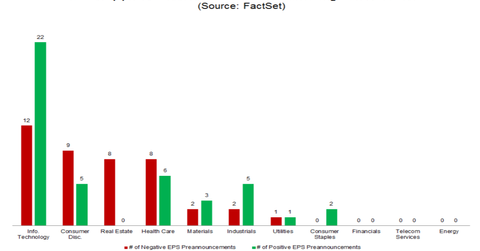

The above presentation by Factset shows that among all the S&P 500 sectors, companies in the IT sector have the strongest earnings guidance. Tech companies are seeing a surge in their stocks primarily due to the improved earnings guidance.

PE is a useful metric, as it measures not only the company’s past performance but also takes into account market expectations for a company’s growth. Generally speaking, stock prices are a reflection of investors’ expectations and the value of a company. Thus, growth prospects are already accounted for in the stock price. Thus, a PE (price-to-earnings) ratio is a reflection of the market’s optimism and pessimism concerning a company’s growth prospects.