What Drove Starbucks’s Earnings per Share in Fiscal 2017?

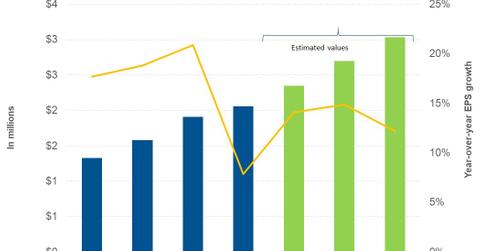

In fiscal 2017, Starbucks (SBUX) posted adjusted EPS (earnings per share) of $2.06, which represents growth of 7.9% from its $1.91 in fiscal 2016.

Jan. 16 2018, Updated 7:32 a.m. ET

Fiscal 2017 EPS

In fiscal 2017, Starbucks (SBUX) posted adjusted EPS (earnings per share) of $2.06, which represents growth of 7.9% from its $1.91 in fiscal 2016. The EPS growth was driven by revenue growth and share repurchases. However, some of the growth in EPS was offset by a decline in EBIT margins and a higher effective tax rate.

In fiscal 2017, Starbucks repurchased 37.5 million shares for $2.1 billion. By the end of fiscal 2017, the company had authorization to repurchase 80.3 million shares under its share repurchase program. Share repurchases reduce the number of shares outstanding, boosting the company’s EPS. Starbucks effective tax rate stood at 33.2%, compared to 32.9% in fiscal 2016.

Peer comparisons

For the same period, McDonald’s (MCD), Dunkin’ Brands (DNKN), and Domino’s Pizza (DPZ) posted EPS growth of 13.9%, 16.0%, and 33.9%, respectively.

Outlook

For fiscal 2018, Starbucks’s management has set its EPS guidance in the range of $2.30 to $2.33, which represents growth of 11.7% to 13.0% from $2.06 in fiscal 2016. Going forward, Starbucks’s management expects its EPS to grow at 12.0%, annually.

For fiscal 2018, analysts expect the company to post EPS of $2.35, which represents year-over-year growth of 14.1%. The EPS growth is expected to be driven by revenue growth, expansion in EBIT margins, a lower effective tax rate, and share repurchases. For fiscal 2019 and 2020, analysts expect the company’s EPS to grow 14.9% and 12.2%, respectively.

Next, we’ll look at Starbucks’s valuation multiple.