Is Canadian Pacific’s Free Cash Flow Enough for Dividend Growth?

Now let’s examine the free cash flow levels of Canadian Pacfic and compare it to its arch-rival Canadian National Railway (CNI).

Dec. 4 2020, Updated 10:50 a.m. ET

CP’s operating cash flow

In the previous article, we considered the dividend payouts and dividend yields of Canadian Pacific Railway (CP) and its peers. Here, we’ll examine the free cash flow levels of the company and compare it to its arch-rival Canadian National Railway (CNI).

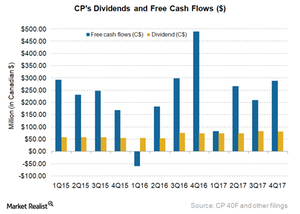

Cash distributions in the form of dividend and stock buybacks are made up of free cash flow (or FCF). FCF is derived from subtracting capital expenditure from a company’s operating cash flow (or OCF). If operating cash flow rises, then it results in higher free cash flow.

In the last ten years, CP’s operating cash flows have steadily risen. From 942.9 million Canadian dollars in 2008, the company’s operating cash flow rose to 2.2 billion Canadian dollars in 2017. Its capex (capital expenditure) rose from 815.9 million to 1.3 billion Canadian dollars during the same period. In fact, CP’s capex has been range-bound in the last five years ending in 2017.

CP’s free cash flow

At the end of 2017, Canadian Pacific Railway’s free cash flow was 842.0 million Canadian dollars. This amount is expected to rise steadily to 1.5 billion Canadian dollars by 2020. Taking into account Canadian Pacific’s yearly dividend payment of ~326.3 million Canadian dollars, its level of free cash flow supports its dividend payment.

Canadian National Railway’s free cash flow rose from 607.0 million Canadian dollars in 2008 to 2.8 billion Canadian dollars in 2017. This shows that CNI has been much better than CP in terms of free cash flow generation. However, note that Canada’s largest freight rail (IYJ) company has spent 1.2 billion Canadian dollars in yearly equity dividend payments in the last year.

Peers’ free cash flows

Norfolk Southern (NSC), Union Pacific (UNP), and Kansas City Southern’s free cash flows support their dividend payments. However, major eastern US rail carrier CSX (CSX) doesn’t have enough FCF to justify the present level of its dividend payments.

In the next article, we’ll take a look at the stock returns of Canadian Pacific Railway and its peers.