How Analysts View E*TRADE Financial in February 2018

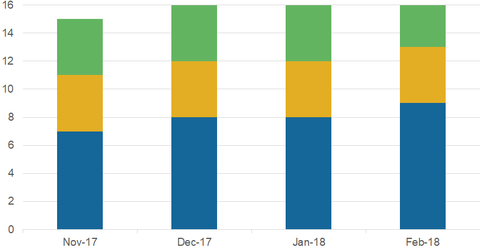

E*TRADE Financial Corporation (ETFC) is covered by 16 analysts in February 2018. Of these analysts, nine suggested a “strong buy” and three gave “hold” ratings on ETFC.

Feb. 8 2018, Updated 10:31 a.m. ET

Ratings on ETFC

E*TRADE Financial Corporation (ETFC) is covered by 16 analysts in February 2018. Of these analysts, nine suggested a “strong buy” and three gave “hold” ratings on ETFC. Four analysts recommended “buy” ratings on E*TRADE stock.

Of the 16 analysts that covered ETFC stock in January 2018, eight analysts suggested a “strong buy,” four rated it a “buy,” and recommended a “hold.”

ETFC’s competitors

Wall Street analysts’ ratings on GAIN Capital Holdings (GCAP) remained the same as in the past few months. The company is covered by four analysts in February 2018, of which three suggested a “hold” and one rated the stock as a “buy.”

CME Group (CME) is covered by 15 analysts in February 2018, of which three rated it a “strong buy.” Six analysts suggested a “buy,” and the remaining six analysts gave it a “hold.”

In the previous month, 14 analysts tracked CME, of which three rated it a “strong buy,” five suggested a “hold” on the stock, and six analysts gave CME a “buy” rating.

Wells Fargo (WFC) is covered by 32 analysts in February 2018. Three analysts gave WFC a “strong sell” rating, 12 rated the stock as a “hold,” and two analysts suggested a “sell.” Seven analysts gave WFC a “buy” rating, and eight analysts suggested a “strong buy” on the stock.