Dick’s Sporting Goods: What Analysts Recommend after Fiscal 4Q17

As of March 13, 2018, 61% of the 31 analysts covering Dick’s Sporting Goods (DKS) stock are recommending a “hold.”

March 16 2018, Updated 9:01 a.m. ET

Rating summary

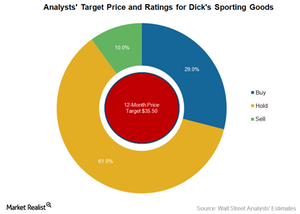

As of March 13, 2018, most of the analysts covering Dick’s Sporting Goods (DKS) are recommending a “hold.” Of the 31 analysts covering the stock, 61% recommend a “hold,” 29% recommend a “buy,” and 10% recommend a “sell.”

Following the company’s results, there have been no price revisions, but we can probably expect some changes in the coming days.

Currently, analysts’ 12-month average target price for the company is $35.50, which reflects an 8% upside to its stock price on March 13, 2018.

Where do peers stand?

Of the 22 analysts covering Foot Locker (FL), 32% have given it a “hold,” and 59% have given it a “buy.” For Big 5 Sporting Goods (BGFV), 100% of the analysts covering the stock have recommended a “hold.” Hibbett Sports (HIBB) received a “hold” rating from 57% of the analysts covering the stock, and 29% rated it a “buy.” For Finish Line (FINL), 13% of the 16 analysts covering the stock recommended a “buy,” and 63% rated it a “hold.”

Currently, analysts’ target price for Foot Locker is $51.60, reflecting a 17.7% upside to the stock as of March 13, 2018. Big 5 Sporting Goods’ mean target price is $5.75, which indicates a 14.2% downside to its stock price as of March 13, 2018. Hibbett Sports’ target price is $26.81, implying an 18.4% upside to its stock price as of March 13, 2018. Finish Line’s mean target price is $12.44, which indicates a 20.1% upside to its stock price as of March 13, 2018.

Valuation overview

On March 13, 2018, Dick’s Sporting Goods was trading at a 12-month forward PE (price-to-earnings) ratio of 11.6x. In comparison, Finish Line, Foot Locker, and Big 5 Sporting Goods were trading at 12-month forward PE ratios of 13.6x, 9.8x, and 12.4x, respectively.