Will the Technology Sector Keep Up the Blaze?

The information technology sector shined last year. A rapid increase in tech stocks and earnings growth contributed to the bull run.

Nov. 20 2020, Updated 2:47 p.m. ET

Don’t look now, but your technology sector is on fire

The S&P500 Information Technology Sector GICS level 1 is up by a whopping 39% since last January. Post-election, pre-inauguration, there seemed to be some worry about the sector for two reasons.

The first was the issue of visas and whether President Trump would crack down on some of the highly skilled workers needed in the tech industry from other countries. It seems as though that issue was overblown, at least as it pertains to tech firms getting the talent they need.

Second, Silicon Valley was initially fairly hostile to President Trump, and there was concern over some type of retribution. (President Trump has called Amazon a monopoly several times.) Instead, the economy picked up, and tech companies should also benefit from lower taxes. Plus, they benefit much more than some other sectors in their ability to repatriate their cash.

So investors will likely be looking for buybacks, dividends, and acquisitions. Sure, some companies are pricey, but overall, the sector (GICS) forward PE (price-to-earnings ratio) is only 18x. TECL (3x Bull) has got you covered if you like these trends, and TECS (3x Bear) is your instrument if you aren’t buying it.

Market Realist

Technology sector shined in 2017

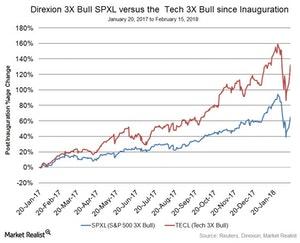

The information technology sector (XLK) (QQQ) shined last year. A rapid increase in tech (technology) stocks’ performances and earnings growth contributed to the bull run in the equity market last year.

The recently approved tax reform legislation focused on companies saving on earnings and doing business in the United States. However, in an article in the Financial Times, Michael Underhill, chief investment officer at Capital Innovations, stated that he believes financials and industrials could benefit from tax reform rather than the tech sector, which already enjoys a lower effective tax rate. He downgraded the tech sector to “neutral” from “underweight” last year.

According to a FactSet report on February 16, 2018, with 80% of the tech companies reporting earnings for 4Q17, the information technology sector has reported the highest year-over-year earnings growth of 22%. The chart above shows that for 2018, the earnings growth for the tech sector is expected to be in the double digits.

Mixed expectations

After the recent market sell-off and a decline in tech stocks last month, many analysts have mixed expectations for the sector in 2018. However, tech stocks hold the highest weight in the S&P 500. The performances of tech stocks drive the overall market performance since they are highly correlated with each other. Over the last 12 months, the correlation between the S&P Information Technology sector index (XLK) and the S&P 500 (SPY) (SPX-INDEX) stood at 0.97, implying that they move in tandem.

Tech companies also face pressure to improve their products and services from time to time. But whether or not tech stocks continue to dazzle in 2018, investors can opt for the Direxion Daily Technology Bull 3X ETF (TECL) and the Direxion Daily Technology Bear 3X ETF (TECS).