Jefferies Revises Target Prices for Diamond Offshore, Noble

Article focus In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23). Revisions in Week 8 Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a […]

Nov. 20 2020, Updated 1:32 p.m. ET

Article focus

In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23).

Revisions in Week 8

Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a “buy” rating on the stock. It also reduced the target price for Noble (NE), to $5 from $6, and maintained a “buy” rating. NE’s target price was also reduced by Wells Fargo to $4 from $5.

Revisions in Week 7

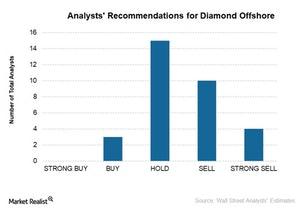

Many analysts revised their target prices for Diamond Offshore (DO):

- Credit Suisse reduced its target price to $14 from $15 and maintained a “neutral” rating.

- Evercore reduced its target price to $19 from $20 and maintained an “outperform” rating.

- RBC reduced its target price to $17 from $19.

- Wells Fargo reduced its target price to $17 from $18.

- Susquehanna reduced its target price to $15 from $17.

- Citigroup, Simmons, UBS, and Jefferies reduced its target price to $12, $9.35, $20, and $12, respectively.

Revisions in Week 6

Raymond James downgraded Diamond Offshore to “underperform” from “market perform,” and Jefferies reduced its target price to $14.