Inside Alphabet’s Capital Allocation Strategy

In 4Q17, Alphabet set aside $9.9 billion to cover taxes on its accumulated foreign profits in relation to the recent US tax reforms.

Feb. 16 2018, Updated 10:31 a.m. ET

Alphabet sets aside $9.9 billion for taxes

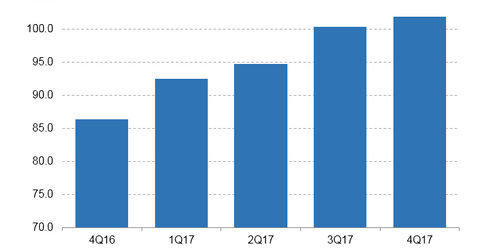

Alphabet’s (GOOGL) cash holdings grew to ~$102.0 billion at the end of 2017, compared with $86.4 billion at the end of 2016. Alphabet, the parent of Google, is among the US multinationals that have accumulated significant cash holdings overseas. Apple, Cisco Systems, Microsoft (MSFT), and Facebook (FB) are among these companies.

In 4Q17, Alphabet set aside $9.9 billion to cover taxes on its accumulated foreign profits in relation to the recent US tax reforms. Facebook (FB) said that tax provisions caused a $0.77 negative hit on its earnings per share in 4Q17. Amazon (AMZN) also reported a 4Q17 profit hit due to the recent changes to the tax law.

Alphabet’s capital allocation framework

The US Congress overhauled the tax law in December to allow American multinationals to repatriate their accumulated overseas profits at a maximum tax rate of 15.5%, a significant reduction from the previous tax rate of 35.0%.

With the path cleared for Alphabet to tap into its overseas profits with a lighter tax obligation, the company recently shared a framework of its capital allocation plan for 2018.

According to Alphabet’s chief financial officer, Ruth Porat, the company intends to use its cash to support organic growth in its various businesses. However, the company is also open to some small merger and acquisition deals, especially to support its cloud, video, and hardware businesses.

$8.6 billion in repurchases

Alphabet (GOOGL) is also boosting its capital returns to shareholders as the path clears for it to repatriate its foreign profits at a reduced tax rate. In connection with this development, the company boosted its share repurchase program by $8.6 billion.