Inside Abbott Laboratories’ 4Q17 Earnings Results: Key Highlights

Abbott Laboratories (ABT) reported sales of $7.6 billion and adjusted diluted EPS (earnings per share) of $0.74 for fiscal 4Q17.

Feb. 1 2018, Updated 5:25 p.m. ET

ABT’s 4Q17 earnings results

On January 24, 2018, Abbott Laboratories (ABT) announced its 4Q17 and fiscal 2017 earnings results. The company reported sales of $7.6 billion and adjusted diluted EPS (earnings per share) of $0.74 for fiscal 4Q17.

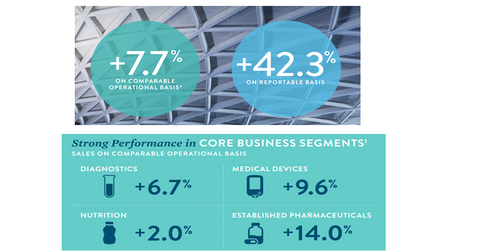

Both the sales and EPS results exceeded the Wall Street analysts estimates of 2.7% and 1.1%, respectively. The company’s YoY (year-over-year) sales growth came in at ~42.3%, while its EPS growth was reported to be ~13.9%.

On an operational basis, ABT’s 4Q17 sales growth came in at ~7.7%, which included a positive currency impact of 2%. On a reported basis, comparable operational sales growth for the quarter was 9.7%. The adjusted gross margin ratio for fiscal 4Q17 was reported to be ~58.8% of the company’s total sales.

The comparable operational sales growth results included St. Jude Medical sales adjustments for the prior year but excluded the sales of St. Jude’s vascular closure business and Abbott’s medical optics business, which were divested in 1Q17, as well as the fiscal 2017 sales of Alere, which Abbott acquired in October 2017.

ABT stock gained more than 4% on January 24, 2018. The iShares Core S&P 500 ETF (IVV) rose ~0.97% that day. Notably, ABT stock makes up ~0.45% of IVV’s total portfolio.

Abbott’s performance for fiscal 2017

For fiscal 2017, Abbott Laboratories reported adjusted diluted EPS of $2.5, which represented a YoY rise of ~13.6% and was at the higher end of the company’s guidance range of $2.48–$2.50. The company reported fiscal 2017 sales of ~$27.4 billion, which represented a YoY growth of ~31.4%.

Abbott reported better-than-estimated cash flows for fiscal 2017. Its operating cash flows came in higher than $5 billion, while its free cash flows turned out to be over $4 billion.

By comparison, peers Zimmer Biomet Holdings (ZBH), Stryker (SYK), and Align Technology (ALGN) posted fiscal 2017 sales growth of 1.8%, 9.9%, and 36.4%, respectively.