What Could Drive FireEye Shares Higher

FireEye (FEYE) is not yet GAAP-profitable. Though the company has managed to improve its net margin from -104% in 2014 to -29.3% in 2018, it’s likely to improve to -12.5% by 2021.

April 22 2019, Updated 2:16 p.m. ET

Expanding profit margins

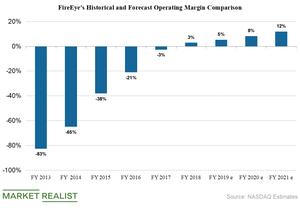

FireEye (FEYE) is not yet GAAP-profitable. Though the company has managed to improve its net margin from -104% in 2014 to -29.3% in 2018, it’s likely to improve to -12.5% by 2021.

However, FireEye has operating leverage of 14.4x, which is far higher than Fortinet (FTNT), CheckPoint (CHKP), Symantec (SYMC), and Proofpoint’s (PFPT) 1.18x, 1.1x, -3.9x, and 0.85x, respectively.

So every $1 dollar rise in sales will increase FireEye’s operating profit by $14. The company’s EPS are expected to grow at a more-than-impressive compound annual growth rate of 114% over the next five years.

Earlier this year, J.P. Morgan (JPM) upgraded FireEye shares as the investment bank was optimistic about the company’s improving margins.

Strong balance sheet

FireEye has a debt balance of $962.6 million while its cash stands at $1.12 billion, which means FireEye can easily repay its debt and interest obligations. The company generated operating cash flow of $17 million, indicating an operating cash to total debt ratio of just 1.8%. The company can easily cover its short-term obligations as it has a current ratio of 2.04x.

Investors are banking on FireEye to improve profit margins and grow billings with a shift to software services. However, sales growth in single digits and a market growing at a robust pace might mean more questions than answers. FireEye might also have to increase its debt to fund its operations, which could bring its margins under pressure.