What Impacted Weatherford’s 1Q17 Performance?

Weatherford’s North America region’s 1Q17 operating loss improved to $18 million—compared its operating loss of $128 million last year.

May 1 2017, Published 9:12 a.m. ET

Weatherford International’s performance

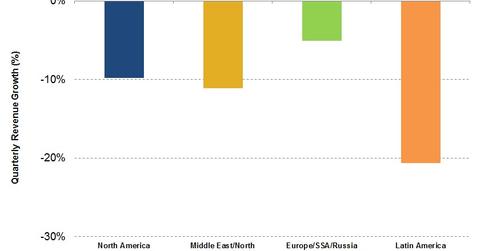

Revenues from Weatherford International’s Land Drilling Rigs segment fell the most (25% fall) from 1Q16 to 1Q17. Weatherford’s Europe/Sub Saharan Africa/Russia region’s revenues fell moderately (~5% fall) during the same period. In comparison, Schlumberger’s (SLB) 1Q17 revenues rose 6% compared to the previous year. Weatherford accounts for 0.36% of the ProShares Ultra Oil & Gas ETF (DIG).

Weatherford’s North America region’s 1Q17 operating loss improved to $18 million—compared its operating loss of $128 million last year. Weatherford’s Latin America operations had an 80% fall in operating income in 1Q17—compared to 1Q16.

Positive factors

- There was a nearly 25% higher North America rig count in 1Q17 compared to 4Q16. The higher rig count had a positive impact on artificial lift, completion, drilling services, and wireline product line sales.

- There were savings from cost reduction following Weatherford’s North America pressure pumping operation shutting down.

- Sub-Sahara Africa and Europe had increased low margin product sales.

- There were higher well construction and secure drilling services sales in Latin America, which have a high operating margin.

Negative factors

- The Middle East/North Africa/Asia Pacific region had lower product sale and depressed pricing.

- The Gulf States had drilling and contract activity.

New contracts

- Weatherford received a contract in western Canada for more than 40 pumping units for an upstream operator.

- Weatherford received a 30-month contract to provide integrated services in shallow-water Mexico. The contract is valued at $178 million.

- In the Middle East, Weatherford’s contracts with two large national oil companies have been extended through 2018.

Next, we’ll discuss Weatherford International’s returns.