A Look at NxStage Medical’s Financial Performance

NxStage Medical (NXTM) generated revenue of $393.9 million in 2017 compared to $366.3 million in 2016.

Feb. 22 2018, Updated 11:03 a.m. ET

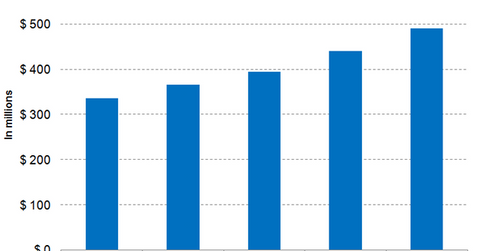

Revenue trend

NxStage Medical (NXTM) generated revenue of $393.9 million in 2017 compared to $366.3 million in 2016. This rise in revenue was attributable to contractual price improvements and an increase in the number of patients being prescribed the use of System One.

For 2018 and 2019, NxStage Medical is expected to report revenues of $440.6 million and $489.8 million, respectively.

The company’s cost of revenue rose from $214.3 million in 2016 to $225.6 million in 2017. As a result, the company’s gross profit rose ~16% from $151.9 million in 2016 to $168.2 million in 2017.

Operating expenses

NxStage Medical’s total operating expenses—a combination of selling and marketing, research and development, distribution, and general and administrative expenses—rose from $156.2 million in 2016 to $182.1 million in 2017.

The company’s research and development expenses rose to $39.6 million in 2017 from $31 million in 2016. Similarly, its general and administrative expenses rose from $32.7 million in 2016 to $41.8 million in 2017.

Its selling and marketing expenses were $68.2 million in 2017 compared to $63.8 million in 2016. Its distribution expenses rose from $28.5 million in 2016 to $32.4 million in 2017.

As a result of this increase in operating expenses, NxStage Medical incurred a loss from operations of $13.8 million in 2017. In 2016, this figure was $4.2 million.

Bottom line

NxStage Medical’s net income widened from -$4.7 million in 2016 to -$14.4 million in 2017. This significant increase in losses translated to the company’s net income per share falling three-fold to -$0.22 in 2017 compared to -$0.07 in 2016.