How Analysts View Blackstone

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.”

Dec. 28 2017, Updated 9:00 a.m. ET

Consistent ratings

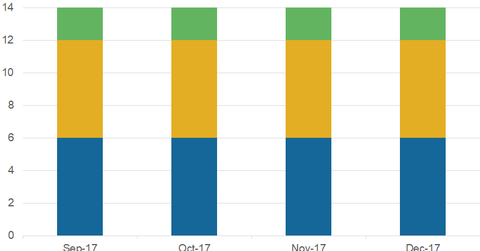

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.” No analysts are suggesting “strong sell” or “sell” ratings on BX.

Ratings on the alternative asset manager haven’t changed over the past few months.

Blackstone could, however, witness more positive ratings in the coming months. The geographies in which it plans to make investments have positive outlooks, which could benefit the company.

Ratings on other asset managers

Eaton Vance (EV) is being tracked by nine analysts in December. Two have given it “buy” ratings, and seven have given it “holds.” No analysts tracking EV have suggested “strong buys,” “strong sells,” or “sells” on the stock. The stock’s ratings were the same last month.

Eight analysts were tracking EV in October 2017. One gave the stock a “buy” rating, and seven suggested “hold” ratings in the month.

Blackstone’s competitor (XLF) Greenhill & Co. (GHL), is being tracked by eight analysts in December. Three have given it “strong sell” ratings, one has suggested a “sell” rating, and four have recommended “hold” ratings. In November 2017 and October 2017, GHL’s ratings were the same.

In September 2017, eight analysts were tracking GHL. One gave it a “strong buy,” three suggested “strong sells,” one recommended a “sell,” and three recommended “holds.”

In December 2017, Brookfield Asset Management (BAM) was tracked by eight analysts. Five recommended “strong buys,” one suggested a “hold,” and two recommended “buys” on the stock.