Brookfield Asset Management Inc

Latest Brookfield Asset Management Inc News and Updates

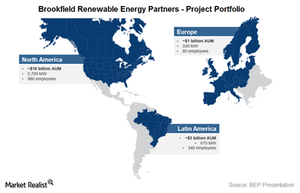

Brookfield Renewable Energy: Biggest Yieldco by Asset Base

With over 6,700 MW of hydro and wind capacity under operation, Brookfield Renewable Energy Partners (BEP) dwarfs all other yieldcos we’ve looked at.

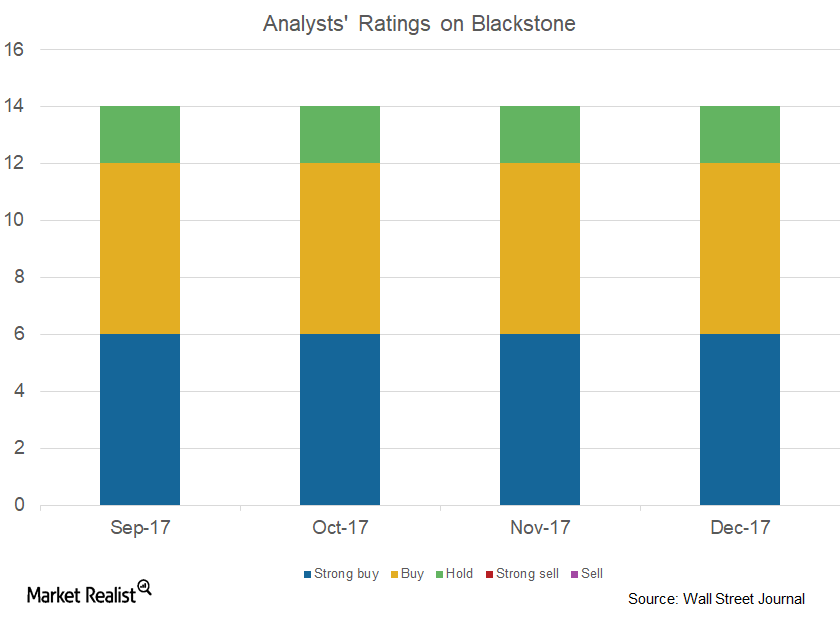

How Analysts View Blackstone

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.”

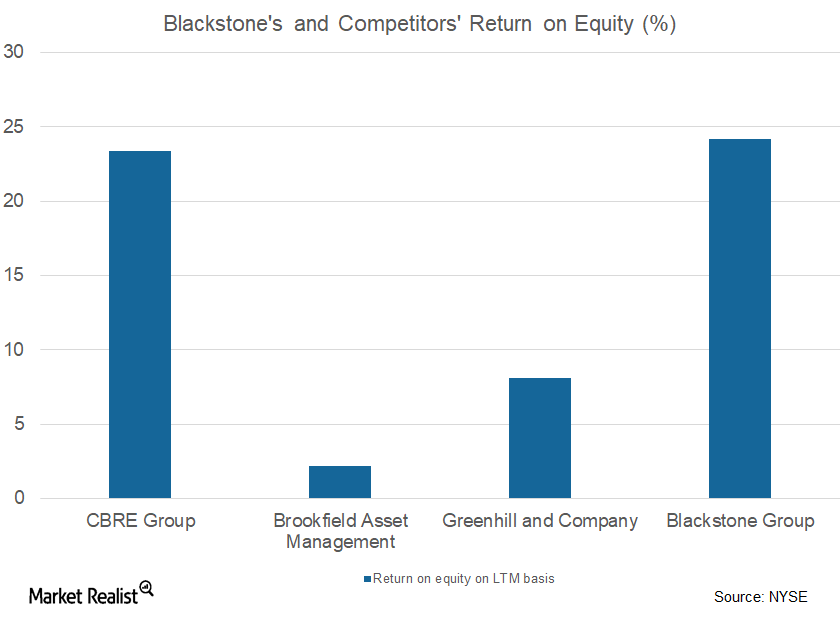

Blackstone’s Private Equity Division Saw a Strong Performance

The Blackstone Group’s (BX) private equity division posted total revenue of $1.4 billion in the first nine months of 2017, compared to $895.3 million in the first nine months of 2016.