AK Steel Could Face Challenges in Meeting Its Goals

AK Steel is working towards stable margins throughout the business cycle. AK Steel has deliberately lowered its exposure to spot markets (X) (CLF).

Dec. 4 2020, Updated 10:53 a.m. ET

Challenges

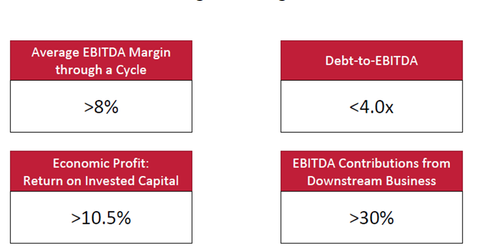

In the previous part, we discussed AK Steel’s (AKS) strategic priorities. AK Steel wants to generate 30% of its EBITDA (earnings before interest, tax, depreciation, and amortization) from the downstream business. AK Steel is aiming for an average adjusted EBITDA margin of 8% across the business cycle. AK Steel plans to work towards lowering its leverage ratios and generating economic profits. In this part, we’ll discuss the challenges that AK Steel could face.

Downstream business

Looking at AK Steel’s current downstream portfolio, its Precision Partners acquisition is expected to generate an adjusted EBITDA of ~$50 million. AK Steel’s subsidiary, AK Tube is in the “mid-$20 million range.” To reach the 30% target, AK Steel would need to at least double its contribution from the downstream business. According to AK Steel, the additional growth is expected to be split equally between organic growth and acquisitions.

While downstream acquisitions might look compelling, they could lead to higher leverage. Even Nucor (NUE) made a few downstream acquisitions in 2016. However, lowering the leverage is AK Steel’s strategic priority.

Stable margins

AK Steel is working towards stable margins throughout the business cycle. AK Steel has deliberately lowered its exposure to spot markets (X) (CLF). While lower spot exposure helps prevent volatility in average selling prices and supports margins, it also means that AK Steel partially misses out on the uptick in steel prices (MT).